Atilla Yeşilada Warns: “The Gold Rally Is a Bubble — TL Investors Will Regret Fleeing”

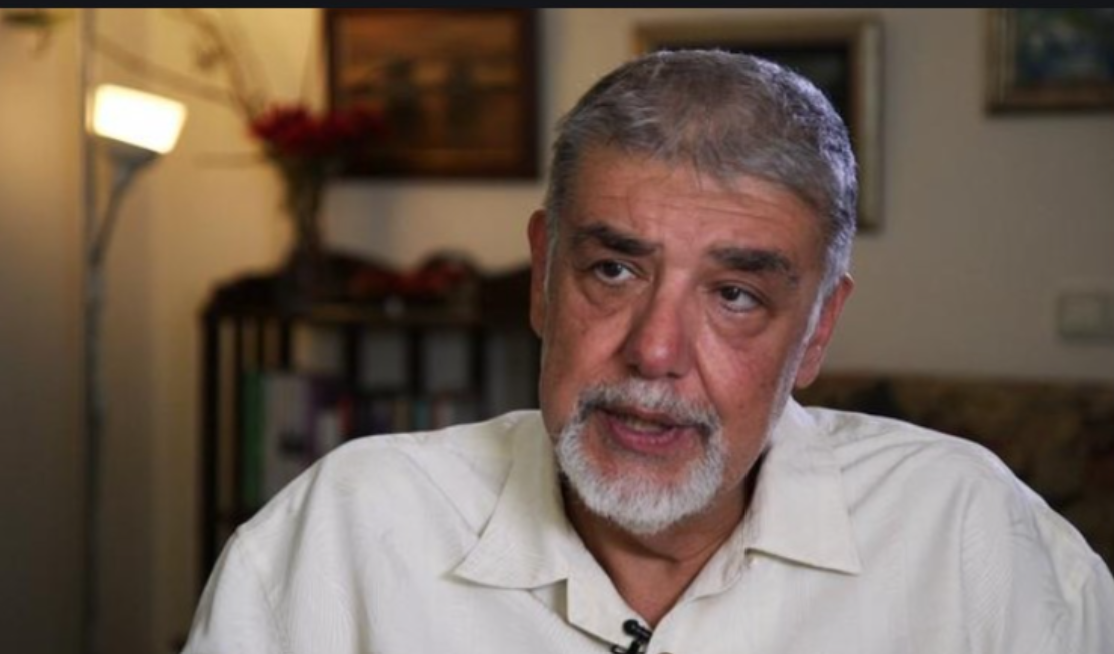

atilla7

atilla7

As gold prices shattered all-time records above $4,000 per ounce, Turkish economist Atilla Yeşilada issued a stark warning to investors, calling the surge “an unsustainable bubble” and urging Turks to stay in the lira. In his latest economic commentary, Yeşilada predicted a sharp reversal in gold and warned that demand was already “eating itself.”

Gold Surges to Historic Levels

Gold’s unstoppable rally has reached historic proportions. The spot price surpassed $4,000 per ounce for the first time ever on global markets, while in Istanbul’s Grand Bazaar, gram gold hit ₺5,500 and quarter gold reached ₺9,500 — both record highs.

The surge comes as millions of Turks, battered by soaring inflation, seek safety in the traditional “safe haven” asset. But Yeşilada, speaking on Mesele Ekonomi, cautioned that the rally has no rational basis and may soon collapse.

“There is no realistic reason behind this rise,” he said. “Gold has already gained 35–40% in dollar terms. It’s turning into a massive bubble. Investors should stop buying and start taking profits.”

“A Dangerous Turning Point”

Yeşilada warned that gold prices had reached a “dangerous threshold” for investors and predicted a strong correction ahead.

“The needle will turn — that’s inevitable,” he said. “Prices are likely to fall sharply. Buying gold at these levels is one of the worst investment decisions you can make.”

He added that the rally was driven more by fear and herd behavior than by fundamentals. “At some point, the market will run out of buyers. When that happens, the fall will be fast and painful,” he said.

“Fleeing the Lira Is a Mistake”

In his latest YouTube broadcast, Yeşilada broadened his critique to Turkey’s entire investment landscape, arguing that panic outflows from the Turkish lira are misguided.

“The Central Bank will not cut rates aggressively,” he said. “As long as it controls the exchange rate, lira deposits will remain more profitable. There’s no currency crisis on the horizon. Those fleeing the TL now will regret it — they’ll lose money in dollars and come back to lira later.”

He dismissed speculation of a collapse in the Turkish currency and instead pointed to a temporary overreaction among savers seeking safety in foreign assets.

“Gold Demand Is Eating Itself”

Yeşilada said the gold rush in Turkey has reached saturation, with jewelers in the Grand Bazaar suspending sales as prices spiral beyond reach for average consumers.

“People can’t afford to buy even a quarter gold coin from their salary anymore,” he said. “The demand is eating itself. Gold gifts at weddings have become a luxury.”

He noted that the surge in gold prices has also begun to distort other markets, reducing household spending on housing and automobiles — an effect he expects to reverse once prices stabilize.

Inflation, Industry, and Policy

Turning to Turkey’s broader economic picture, Yeşilada criticized the government for relying solely on the Central Bank in its fight against inflation.

“This cannot be fixed without budget discipline and structural reforms,” he said. “Freeze the salaries of MPs and the Presidential allowances. If you want to convince the public, set an example.”

He called the recent rebound in industrial output “temporary,” citing rising political pressure and uncertainty as key reasons why major firms are relocating production from Turkey to countries like Egypt.

“Rare Earths Must Be Processed at Home”

Commenting on reports of large rare earth element reserves discovered near Eskişehir, Yeşilada described them as a strategic opportunity but warned against repeating past mistakes.

“Selling unprocessed ore is meaningless,” he said. “The real value lies in bringing technology to Turkey — not exporting raw materials.”

He added that the upcoming Halkbank trial in the United States could cost Turkey between $1 billion and $40 billion, depending on the outcome.

“The case was opened by the U.S. Department of Justice. They can withdraw it if they choose — it’s political. But if Turkey loses, the financial cost will be enormous.”

“Without Justice, There Is No Confidence”

In his closing remarks, Yeşilada said the only sustainable path to economic recovery lies in restoring the rule of law.

“The most dangerous point is that people no longer believe the money they earn will stay in their pockets,” he warned. “Without trust in justice, there can be no lasting prosperity.”