ANALYSIS: Türkiye Posts October Current Account Surplus as Services Revenues Surge

current account oct2025

current account oct2025

Summary:

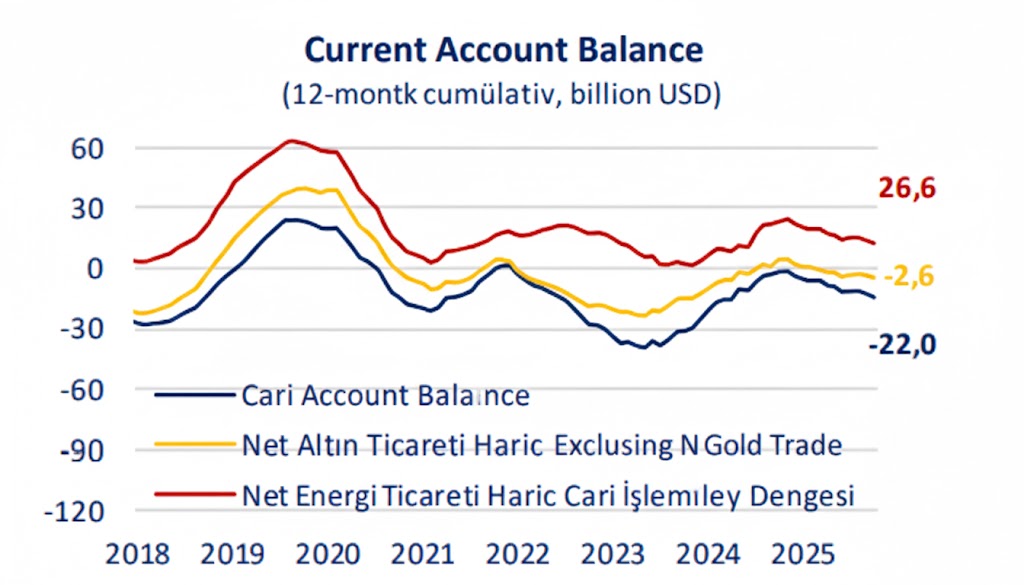

Türkiye’s current account returned to surplus in October, supported by strong services revenues despite a widening foreign trade deficit. Direct investment flows recorded the sharpest monthly outflow since 2014, while portfolio and other investment categories showed a mixed performance. Economists expect the current account to maintain a modest improvement heading into year-end.

Current Account Records USD 457 Million Surplus in October

Türkiye’s current account posted a USD 457 million surplus in October, broadly in line with expectations.

Between January and October, the current account deficit widened nearly fivefold to USD 14.5 billion, while the 12-month rolling deficit climbed to USD 22 billion, the highest level in roughly 18 months.

Foreign Trade Deficit Continues to Expand

The balance of payments–defined foreign trade deficit widened 70.2% year-on-year to USD 6 billion in October.

Key contributors included:

-

Non-monetary gold imports jumping 63% to USD 2.8 billion, the highest level in many months

-

Energy imports declining 3.4% to USD 4.8 billion

-

Core trade deficit (ex-gold & energy) narrowing 6% to USD 7 billion

In the first 10 months of the year, gold imports rose 43.4%, while energy imports fell 2.7% from the previous year.

Services Revenues Post Fastest Annual Growth in 12 Months

Net services revenues increased 9.9% year-on-year to USD 7.6 billion in October.

Breakdown:

-

Tourism revenues rose 5.3%, while tourism expenditures jumped 14.6%

-

Net tourism revenues reached USD 5.9 billion

-

Transport revenues surged 32.9% to USD 2.5 billion

During January–October, net services revenues rose 3.4% to USD 56.3 billion, marking one of the strongest performances on record.

Direct Investments See Largest Monthly Outflow Since 2014

Direct investment flows were sharply negative:

-

Turkish residents acquired USD 966 million of assets abroad

-

Foreign investors brought USD 128 million into Türkiye

As a result, net direct investments saw an outflow of USD 838 million, the largest since November 2014.

Year-to-date, net FDI-related inflows reached USD 3.5 billion, a modest 3% annual increase.

Portfolio Investments Register USD 1.2 Billion Outflow

Portfolio flows were mixed in October:

-

Turkish residents increased their foreign portfolio holdings by USD 1.2 billion

-

Foreign inflows into Türkiye amounted to only USD 181 million

Foreign investors recorded:

-

USD 44 million net sales in equities

-

USD 98 million outflows from government bonds (DIBS)

-

Turkish banks purchased USD 529 million of FX-denominated bonds abroad

Other Investments Category Posts USD 2.9 Billion Net Inflow

Other investments saw a sizable improvement:

-

Turkish banks used USD 829 million in net borrowing

-

Non-financial companies borrowed USD 3.1 billion abroad

In the first 10 months of the year, non-financial corporates’ external borrowing rose from USD 1.8 billion to USD 13.5 billion.

Rolling 12-month indicators show long-term debt rollover ratios at:

-

177% for banks

-

168% for corporates

Both remain well above historical averages.

Reserves Decline by USD 1.6 Billion

Official reserves fell USD 1.6 billion in October, bringing total reserve losses since the start of the year to USD 13.1 billion.

The net errors & omissions item posted a further USD 3.2 billion outflow, increasing cumulative outflows to USD 15.6 billion for the January–October period.

Outlook: Moderate Improvement Expected Into Year-End

-

Strong services revenues continue to offset the widening trade deficit.

-

Preliminary November trade data indicate a slowing pace of deterioration.

-

With the tourism season over, services revenues will soften, but analysts expect the current account to record another surplus in December as imports normalize.