Alarming Data Reveals Istanbul Households Struggling to Survive

Credit Card Payments

Credit Card Payments

The Istanbul Planning Agency (IPA), operating under the Istanbul Metropolitan Municipality (İBB), has released a striking report exposing the city’s worsening financial distress. The September 2025 economic report paints a grim picture of daily life in Türkiye’s largest metropolis, where rising inflation and skyrocketing living costs have pushed households to the brink. The findings reveal that many residents can no longer afford even basic needs, while personal debt continues to spiral out of control.

Credit Card Debts Hit Crisis Levels

According to the data cited by Gerçek Gündem, one of the most alarming signs of financial stress is the rapidly growing burden of credit card debt. The report shows that 40% of cardholders could pay only the minimum amount due on their balances in September, signaling widespread repayment struggles. Meanwhile, the share of those who managed to pay their debt in full dropped from 47.6% to 40.6% within a single month—a dramatic decline that highlights the shrinking purchasing power of consumers. Even more concerning, 11.3% of low-income participants reported being unable to make any payment at all toward their credit card bills, raising fears of mounting defaults and financial exclusion. Experts warn that this growing dependence on credit cards to cover daily expenses is unsustainable and could lead to a consumer debt crisis that threatens broader financial stability.

Basic Needs Out of Reach for Many

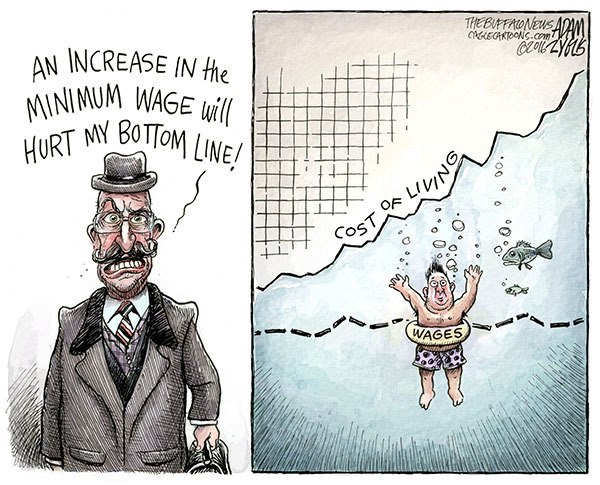

The report also exposes how economic hardship has reached into the daily lives of Istanbul’s residents. A staggering 53.9% of respondents said they are struggling to make ends meet, while 31.4% admitted they can no longer afford even basic necessities—a sharp rise from 22.1% just a month earlier. This surge reflects how continuous price hikes have outpaced wages, leaving families unable to cover essentials such as food, rent, and utilities.

Growing Food Insecurity in Households

Perhaps the most disturbing revelation is the scale of food insecurity. Nearly half of the participants (49.5%) said they fear they will not have enough food for their households. This anxiety underscores how inflation has eroded real incomes, forcing families to cut back on meals or lower food quality. Many households are now prioritizing survival expenses—rent, transportation, and bills—over nutrition, revealing how deeply the cost-of-living crisis is reshaping consumption habits in the city.

Bills Go Unpaid as Costs Rise

In addition to food shortages, late bill payments have become a defining symptom of Istanbul’s economic turmoil. The IPA’s findings indicate that 18.3% of residents failed to pay all their bills and housing fees in September. Among unpaid expenses, electricity bills topped the list (61%), followed by water (52.7%) and natural gas (44.5%). These figures highlight how energy inflation continues to squeeze low- and middle-income families. As autumn sets in and heating needs rise, experts fear an even greater strain on household budgets.

A City on the Edge of Economic Exhaustion

The IPA report reflects a growing sentiment among Istanbul residents that economic survival has replaced stability as the new normal. Persistent inflation, stagnant wages, and a widening wealth gap have pushed consumers to rely on credit to maintain daily life. Many economists warn that the city’s economic fragility could deepen unless urgent policy interventions—such as debt restructuring, income support, and price stabilization—are implemented.

Social Pressure and Psychological Impact

Beyond numbers, the human toll of economic stress is becoming evident. Families facing rising debts and unpaid bills report heightened anxiety, mental fatigue, and feelings of hopelessness. Sociologists caution that long-term exposure to financial insecurity can lead to social alienation and increased demand for public assistance. Istanbul, often seen as the engine of Türkiye’s economy, now stands as a symbol of the nationwide cost-of-living crisis.

The Urgent Need for Policy Action

Experts argue that short-term relief measures—such as temporary subsidies—will not suffice. Instead, they call for structural reforms that strengthen purchasing power, expand access to affordable credit, and stabilize essential commodity prices. The report serves as a stark warning that without intervention, the financial resilience of Istanbul’s households could deteriorate further, amplifying the effects of inflation and deepening social inequality.