How Critical Is Russia to Turkey’s Energy Equation?

dogal gaz2

dogal gaz2

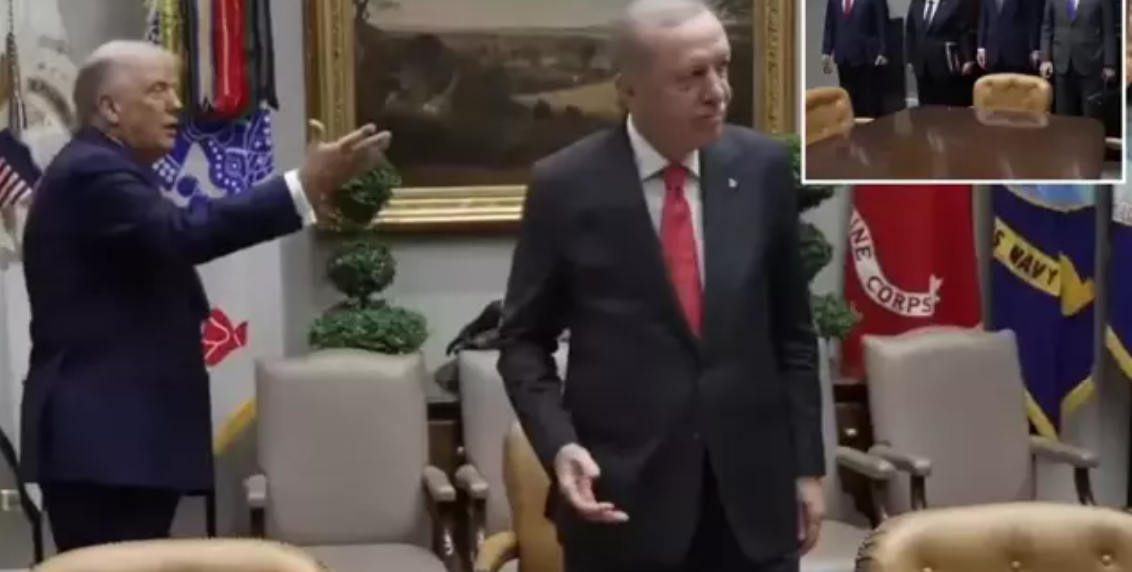

Summary: At a White House meeting with President Recep Tayyip Erdoğan on September 25, U.S. President Donald Trump openly urged Turkey to end its oil and gas imports from Russia. The call highlights Ankara’s heavy dependence on Russian energy, raising questions about Turkey’s ability to diversify supply through LNG deals and new contracts, while balancing sanctions risk, domestic price stability, and geopolitical commitments within NATO.

Trump Presses Ankara on Russian Oil

President Donald Trump has called on Turkey to halt imports of Russian oil and natural gas as part of his administration’s wider economic pressure campaign to end the war in Ukraine.

According to accounts of the September 25 White House meeting, Trump pressed Erdoğan directly, stressing that Turkey — like NATO partners Hungary and Slovakia — should no longer provide an outlet for Russian energy.

While Hungary and Slovakia continue to import Russian crude via the Druzhba pipeline under EU exemptions, Turkey stands out as the only NATO country still receiving Russian oil by sea, and by far the largest buyer.

Turkey’s Energy Dependence on Russia

Turkey’s reliance on Russian hydrocarbons is striking.

-

In 2024, 66% of Turkey’s crude oil and refined product imports came from Russia, according to Energy Market Regulatory Authority (EPDK) data.

-

Dependence on Russian gas was lower but still significant at 41%.

-

Russia controls roughly one-fifth of proven global natural gas reserves, ensuring its role as a strategic supplier.

Discounted Russian oil has helped Turkey cushion domestic costs. Industry sources estimate Ankara has been purchasing crude and petroleum products at 10–15% below international benchmark prices, reflecting Russia’s need to bypass EU sanctions and secure hard currency through alternative buyers such as China, India, and Turkey.

U.S. LNG Deals Offer Alternatives

Despite its dependence, Ankara has taken steps to diversify its gas supply portfolio through long-term liquefied natural gas (LNG) agreements.

Energy Minister Alparslan Bayraktar announced in 2025 that state-owned BOTAŞ signed a 20-year LNG deal with Mercuria, covering around 4 bcm annually for a total of 70 bcm starting in 2026. A separate nine-year preliminary deal with Woodside Energy targets 5.8 bcm of LNG.

These agreements build on Turkey’s existing LNG imports from the U.S., Qatar, Algeria, Nigeria, and Egypt, complementing pipeline gas from Russia, Iran, and Azerbaijan.

LNG: A Costly Substitute?

While LNG enhances supply security, its cost profile remains a challenge.

-

LNG prices are often more volatile than oil, indexed either to European benchmarks such as TTF or U.S. benchmarks like Henry Hub.

-

Spot cargoes, in particular, expose importers to sharp price swings.

-

In energy-equivalent terms, LNG frequently trades at or above the cost of oil.

For Turkey, this means LNG strengthens resilience against geopolitical disruptions but also increases exposure to cost volatility — a delicate balance for a country where natural gas accounts for up to 20% of electricity generation in peak periods.

Gas Supply: A Multi-Pipeline System

Turkey sources pipeline gas through five major routes:

-

Blue Stream (Russia)

-

TurkStream (Russia)

-

Tebriz–Ankara (Iran)

-

Baku–Tbilisi–Erzurum (Azerbaijan)

-

TANAP (Azerbaijan, transit to Europe)

This mix ensures geographic diversity, but Russia remains the dominant supplier. The expansion of LNG terminals and floating storage regasification units (FSRUs) has improved flexibility, allowing Ankara to adjust volumes more dynamically in response to market conditions.

NATO Debate Over Russian Energy

Trump’s call also reignited debate within NATO over member states’ continued reliance on Russian hydrocarbons. While the EU has imposed bans and phased embargoes, several members — including Turkey — remain exceptions.

Analysts note that Ankara’s imports not only provide Moscow with vital revenue but also complicate NATO’s political messaging on isolating Russia. At the same time, Turkey’s discounted access to energy has helped stabilize domestic markets at a time of 32–33% inflation and rising geopolitical costs.

The U.S. Role in Turkey’s Gas Portfolio

The International Energy Agency estimates that the U.S. share of Turkey’s natural gas imports has risen to about 10%, with expectations of reaching 15% under new LNG contracts.

This growing role positions Washington as both a supplier and a political actor, using energy leverage to press Ankara on its Russia ties.

Risks of a Rapid Shift

Should Ankara heed Trump’s call and cut Russian oil imports entirely, analysts warn of immediate disruptions:

-

Diesel shortages could emerge, as Russia remains Turkey’s largest supplier of refined petroleum products.

-

Domestic fuel prices would likely rise, complicating the government’s efforts to contain inflation.

-

Alternative sourcing from the Middle East or U.S. suppliers could fill the gap, but at higher cost and logistical strain.

Thus, while diversification is underway, Russia remains an unavoidable pillar of Turkey’s energy mix in the short term.

Conclusion: Balancing Security, Sanctions, and Cost

Russia continues to play a critical role in Turkey’s energy equation, supplying two-thirds of its oil and over 40% of its gas as of 2024.

New LNG contracts with U.S. and global suppliers offer longer-term relief, but the higher cost and volatility of LNG means pipeline gas — particularly from Russia — remains central.

Trump’s push highlights the geopolitical crosswinds facing Ankara: navigating NATO obligations, U.S. sanctions policy, domestic energy security, and inflation management all at once.

For Turkey, the near-term challenge is clear: reduce reliance without destabilizing domestic markets.

Sources: DW, EPDK, Ekonomim

IMPORTANT DISCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/