ANALYSIS: Industrial Recovery Shows Signs of Stabilisation, but January Signals Mixed Outlook

IP English Dec2025

IP English Dec2025

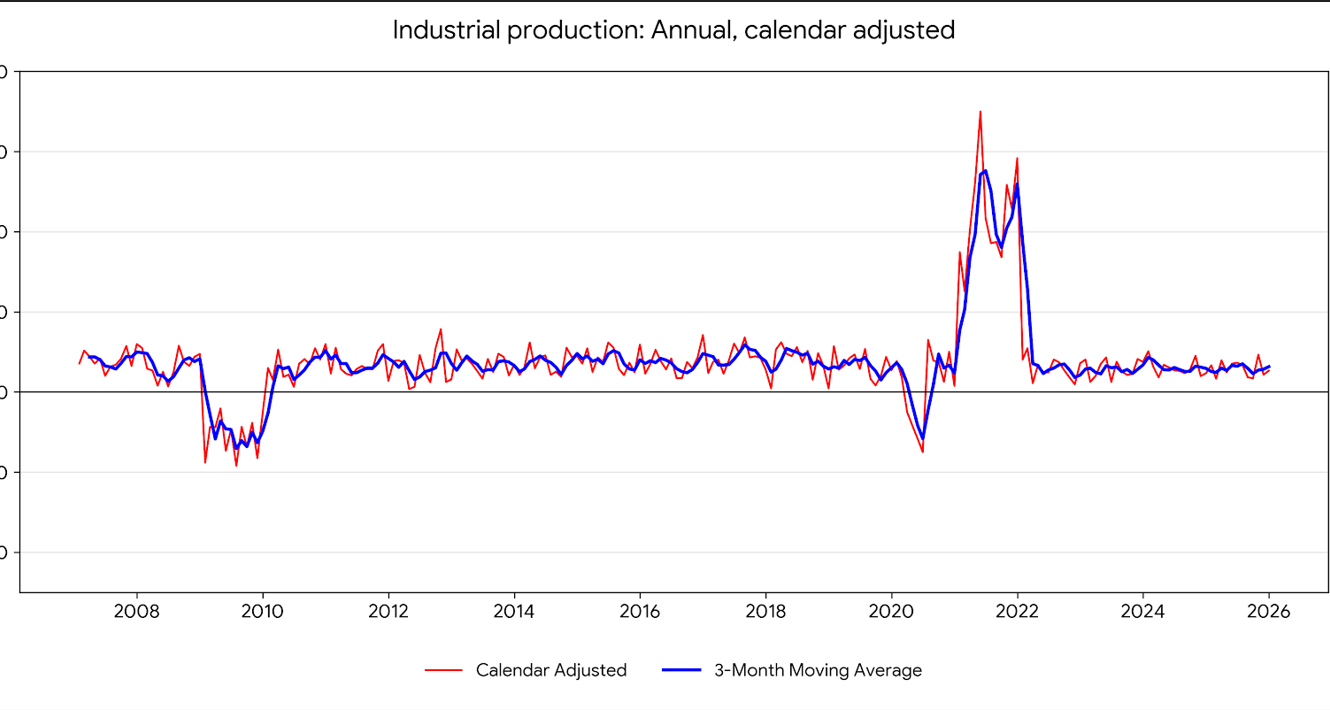

Türkiye’s industrial sector ended 2025 with signs of stabilisation after a prolonged slowdown, as seasonally adjusted data point to a modest recovery in manufacturing activity during the final quarter. However, leading indicators for January 2026 present a more mixed picture, with weakening demand, rising cost pressures, and sector-specific slowdowns suggesting that the path to a sustained recovery remains fragile.

December Data Signal Tentative Bottoming-Out

Alternative indicators derived from processed high-frequency data suggest that the recovery in industrial production continued into December. After adjusting for seasonal and calendar effects, the manufacturing production index rose by 1.0% month-on-month, while the underlying trend index expanded by 0.9%, broadly in line with its long-term average.

Although annual growth remained negative, the gap with the long-term trend narrowed, indicating that momentum is slowly improving. The annual change in the trend-adjusted industrial production index also moved back into positive territory, reinforcing the view that activity may be approaching a cyclical turning point.

Broad-Based Gains, Led by Technology Manufacturing

Manufacturing activity strengthened across most subsectors in December. On a monthly basis, the sharpest increase was recorded in the manufacture of computers, electronic and optical products, which surged by 11.1%. Volatile subsectors also showed notable gains, with overall expansion reaching 16.2%, while high-volatility machinery and equipment installation and repair rose by 10.8%.

Out of 24 manufacturing subsectors, production increased in 15, while 9 experienced contraction. On an annual basis, total industrial output declined by 0.9% in December, marking a slowdown compared with previous months.

Q4 Reversal Suggests End to 2025 Slowdown

Seasonally adjusted figures indicate that industrial production rose by 0.1% quarter-on-quarter in the fourth quarter of 2025. This suggests that the contraction observed in the first three quarters of the year has likely reversed, even though overall output levels remain below long-term averages.

As of December, industrial production continued to trail its historical trend, but the narrowing gap suggests a gradual normalisation process may be underway.

January Indicators Point to Renewed Headwinds

Leading indicators for January 2026, however, paint a more cautious picture. The Istanbul Chamber of Industry (ISO) Manufacturing PMI for January showed that Turkish manufacturers remain under pressure, with new orders continuing to weaken and firms cutting back on production, employment and purchasing activity.

At the same time, input costs and final product prices rose sharply, reaching their highest levels since April 2024. Producer inflation (PPI) increased by 2.67% month-on-month, highlighting persistent cost-side pressures.

External trade data also signalled slowing momentum, with imports down 19.6% and exports contracting by 22.9%, reinforcing concerns about domestic and external demand. In the automotive sector — a key driver of industrial output — domestic car and light commercial vehicle sales fell sharply to 75,362 units in January, down from 191,620 units in December, according to ODMD data.

January Industrial Output Likely to Contract

Taking these indicators together, analysts estimate that industrial production may contract by between 1.8% and 2.1% in January 2026 on a monthly basis.

While tight monetary policy continues to restrain domestic demand, the relative strength of the euro area and supportive public spending could help cushion the slowdown. Still, weak external demand — particularly from China and intensified global competition — may limit the positive spillovers to Türkiye’s manufacturing sector in the near term.

Outlook: Stabilisation, Not Acceleration

Overall, the data suggest that Türkiye’s industrial sector is moving away from a sharp downturn, but remains vulnerable to cost pressures, demand weakness and global uncertainty. A sustained recovery will likely depend on a clearer improvement in new orders, easing inflation dynamics, and a more supportive external environment.

Sources: Yapi Kredi Invest, TSKB, Alnus Invest