No Improvement Yet in External Balance Trend

dis acik

dis acik

Summary

Turkey’s external balance showed no meaningful improvement at the start of 2026, as January trade data pointed to a persistently high trade deficit and renewed weakness in exports. While softer gold and energy trade limited the headline deterioration, core indicators worsened, suggesting that the recent weakening in the current account outlook has carried over into the new year.

Exports Start 2026 in Negative Territory

Commenting on January export figures, Mustafa Gültepe, Chairman of the Turkish Exporters Assembly (TIM), struck a downbeat tone. Despite geopolitical tensions, protectionist measures, and competitiveness challenges in labor-intensive sectors, Turkey’s exports had grown by 4.5% in 2025, but entered 2026 with a contraction.

Exports declined 3.9% year-on-year in January to USD 20.3 billion, while 12-month cumulative exports stood at USD 272.5 billion. Against this backdrop, Akbank Economic Research assessed the external balance outlook, highlighting signs of renewed strain.

Trade Deficit Widens Despite Support from Gold and Energy

According to provisional data from the Ministry of Trade, Turkey’s foreign trade deficit widened by USD 0.8 billion year-on-year in January to USD 8.4 billion. Relatively weaker gold and energy imports helped limit the deterioration. However, excluding gold and energy, the annual widening of the trade deficit was stronger at USD 1.5 billion, pointing to underlying fragility.

Seasonally and calendar-adjusted data indicate that the weak trend observed in the final quarter of last year extended into January. Analysts note that export performance may have been adversely affected by the first working day of the year falling on a Friday, effectively creating a bridge holiday. Even so, the persistence of a large trade deficit suggests that the recent deterioration in the current account balance has carried into the new year.

Exports: Broad-Based Monthly Contraction

On a seasonally adjusted basis, exports fell 5.7% month-on-month in January, following three consecutive months of increases. Gold exports declined from USD 338 million in December to USD 287 million in January, while energy exports dropped sharply by 11.6% after rising 4.2% in the previous month.

Excluding gold and energy, exports fell 5.2% month-on-month, underscoring the breadth of the slowdown.

Regional Breakdown

Regionally adjusted data show the steepest monthly declines in exports to:

-

EU-27: –8.8%

-

Near and Middle East: –9.6%

The contraction in exports to North America was comparatively more limited.

By Product Group

By product category, capital goods exports plunged 11.0%, reversing December’s strong 11.6% increase. Intermediate goods exports fell 4.2%, while consumer goods exports declined 3.8%, indicating a generalized weakening across export categories.

Imports: First Monthly Decline After Four Months of Growth

Imports, adjusted for seasonality and calendar effects, declined 3.9% month-on-month in January, ending a four-month expansion trend. Despite higher gold prices, gold imports fell to USD 1.66 billion, lower than in the previous four months, though they still recorded a year-on-year increase.

Energy imports also corrected sharply, with the strong increase seen in December proving temporary. Energy imports fell 10.6% month-on-month in January.

Core Indicators Send Mixed Signals

By product classification, the steepest decline in imports was recorded in capital goods (–7.7%), followed by consumer goods (–3.6%) and intermediate goods (–3.1%). However, excluding gold and energy, intermediate goods imports rose 1.4% month-on-month, indicating ongoing demand pressures in core production inputs.

When the 304% surge in jewelry imports is excluded, consumer goods imports actually fell 21.3% month-on-month, pointing to signs of cooling domestic demand. Overall, core indicators suggest a slowdown, but not yet a decisive adjustment.

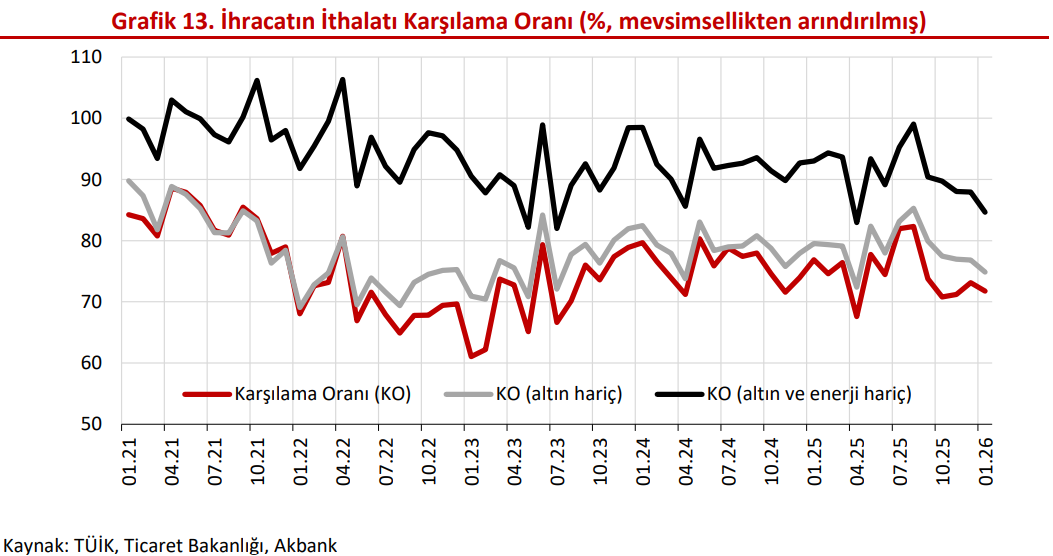

Export Coverage Ratio Falls to Multi-Month Low

As a result, the export-to-import coverage ratio excluding gold and energy, on a seasonally adjusted basis, declined to 84.6% in January, down from 88.0% and marking its lowest level since April 2025.

This deterioration reinforces concerns that external balance risks remain elevated, with no clear improvement yet visible in the trade or current account dynamics.

Source: Ministry of Trade, TİM, Akbank Economic Research