PMI ANALYSIS: Dual Squeeze in Manufacturing – Contraction Deepens as Inflationary Pressures Resurface

pmi turkey jan2026 english

pmi turkey jan2026 english

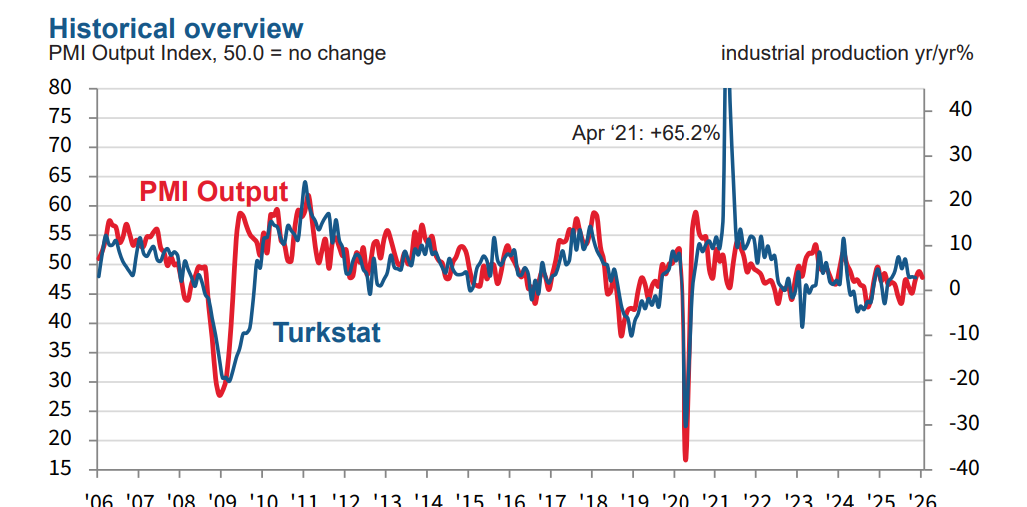

The January data confirms that the manufacturing sector has entered its 22nd consecutive month of contraction. However, the current landscape is markedly different from previous months; while output continues to decline, input costs have surged at the sharpest pace in nearly two years. This divergence suggests the sector is drifting into a “stagflationary” trap, where stagnating growth meets accelerating prices.

1. Cost Burdens and Forced Pricing Power

Rising raw material and energy costs are destabilizing the cost structures of manufacturers. The pace of input price inflation in January reached its highest level since April 2024. Despite weakening demand, producers are increasingly forced to pass these costs on to final product prices to maintain thin margins. This serves as a leading indicator that consumer inflation may remain “stickier” than policymakers hope throughout the first half of 2026.

2. Strategic Downsizing in the Labor Market

Employment in the sector has now contracted for 14 straight months, but the acceleration of job losses in January—hitting the steepest rate since September 2025—is particularly alarming. This trend indicates that businesses are moving beyond natural attrition; they are now actively downsizing capacity. Facing a murky outlook for mid-2026, firms are adopting defensive postures by reducing headcount to protect cash flows.

3. Export Engine Stalls Amid Global Weakness

Weakness in foreign demand is limiting the industry’s ability to offset domestic sluggishness. The combination of slowing growth in key export markets (notably the Eurozone) and rising local production costs is eroding the competitive edge of manufacturers. This suggests that the expected export-led recovery for early 2026 is likely to be delayed, further tightening the liquidity squeeze on firms.

ANALYSIS: Istanbul Inflation Jumps in January – Identifying the Drivers of the “New Year Shock”

4. Sectoral Divide: Necessity vs. Discretionary Spending

The pain is not distributed evenly. Sectors producing food and essential household goods are managing to hover near the break-even point due to inelastic domestic demand. In contrast, discretionary sectors—such as textiles, apparel, and furniture—remain the epicenter of the contraction, struggling with both high operational costs and a consumer base that is increasingly price-sensitive.

Strategic Outlook

These findings complicate the path for monetary easing. With factory-gate inflation picking up speed, any premature move to cut interest rates to stimulate production risks fueling the very inflation that is dampening demand. For manufacturers, the primary theme of 2026 remains “resilience and efficiency” rather than “expansion.”