BIST 100 Delivers Best Performance in Nearly Three Decades

borsa2

borsa2

Positive momentum in Türkiye’s domestic financial markets extended throughout January, with the BIST 100 index delivering a strong rally that culminated in record highs by the end of the month. Sustained buying interest from both domestic and foreign investors helped the benchmark index post its best January performance since 1997, signaling renewed confidence in Turkish assets.

The BIST 100 index began the year with a 0.31 percent gain on the first trading day of January, opening at 11,296.52 points. Buying momentum persisted in the following sessions, pushing the index to 11,726.18 on January 5, marking the year’s first record high.

Foreign investor participation played a key role in sustaining the rally. On January 29, the BIST 100 reached an all-time high of 13,906.51 points, reflecting heightened demand for Turkish equities amid improving macroeconomic indicators and supportive global conditions.

Strong Monthly Gains Place BIST Among Global Leaders

By the end of January, the BIST 100 had posted a monthly return of 22.9 percent. This performance marked the index’s strongest January gain in 28 years. The last comparable surge occurred in January 1997, when the index increased by 64 percent.

With this performance, the BIST 100 ranked second among major global equity indices in year-to-date returns. South Korea’s Kospi index led global markets with a 24 percent gain over the same period, while Türkiye followed closely behind.

In dollar terms, the BIST 100 rose to 320.38 points, testing its highest level since August 2, 2024. Analysts view the index’s recovery in foreign currency terms as particularly significant, given its prolonged underperformance relative to other emerging markets in recent years.

Trading Volume and Liquidity Reach Elevated Levels

January also saw a notable rise in trading activity. The BIST 100 recorded an average daily trading volume of 178.2 billion Turkish lira during the month, reflecting increased investor participation and liquidity.

The highest daily volume was observed on January 29, when turnover reached 302.5 billion Turkish lira, coinciding with the index’s record-breaking close. Market observers interpret the surge in volume as a sign of broad-based participation rather than a narrow, speculative rally.

Declining CDS Supports Repricing of Turkish Assets

Despite ongoing uncertainties related to U.S. economic policy and global geopolitical risks, domestic policy measures have continued to support market sentiment. One of the most closely watched indicators, Türkiye’s five-year credit default swap (CDS) premium, fell to 202.7 basis points in January.

The decline in CDS levels is seen as a key macroeconomic signal for the repricing of Turkish lira–denominated assets. Lower risk premiums, combined with a deceleration in inflation and expectations of interest-rate easing, have created a theoretically supportive environment for risk assets, particularly equities.

As Türkiye’s central bank continues its disinflation strategy, the weakening of the U.S. dollar has also contributed to global disinflation dynamics, thereby indirectly benefiting emerging-market assets.

Foreign Investors Increase Exposure to Turkish Markets

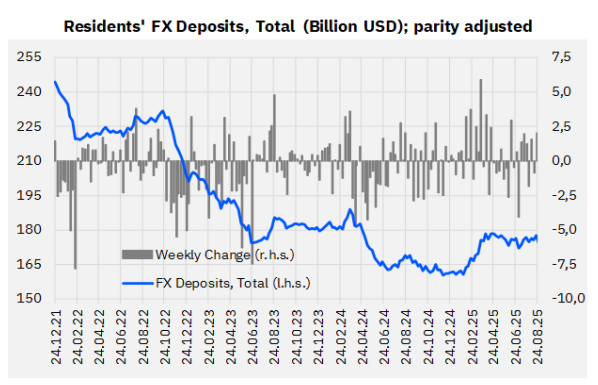

Foreign investor appetite for Turkish assets remained strong throughout the month. Non-resident investors were net buyers in both equity and bond markets, excluding the final week of January.

Foreign investors purchased $3.5068 billion worth of government domestic debt securities and $1.0274 billion in equities during the period. As of the week ending January 23, the total value of shares held by non-residents rose to $39.8663 billion, while their holdings of government bonds increased to $21.5101 billion.

At the same time, the Central Bank of the Republic of Turkey (CBRT) reported that total reserves reached an all-time high of $215.614 billion in the week of January 23, further strengthening investor confidence.

Economist Highlights Improved Macro Outlook

Professor Erhan Aslanoğlu, a faculty member at Istanbul Bilgi University’s Department of Economics, said the rally in the stock market was driven by a combination of domestic and global factors.

“When we look at domestic macroeconomic indicators, the picture is relatively positive in terms of the budget and the balance of payments,” Aslanoğlu said, adding that budget performance in particular has exceeded expectations.

He noted that the current account deficit remains at manageable levels and emphasized the importance of strong central bank reserves.

“Central bank reserves have reached a historical peak,” Aslanoğlu said. “The advantages of holding gold have become very apparent in this process. In particular, interest from foreign investors has increased significantly.”

According to Aslanoğlu, sufficient foreign exchange reserves, relatively low exchange rate risk, and a limited current account deficit have accelerated foreign capital inflows.

“It appears that the Turkish stock market, which had been losing value in foreign currency terms for a long time and lagging behind other developing markets, has entered a phase of closing that gap,” he said. “Globally, there is also a flow of capital from the United States and other developed economies toward developing countries.”