Türkiye–Syria Trade Rebounds as Exports Surge Nearly 70% After Assad’s Ouster

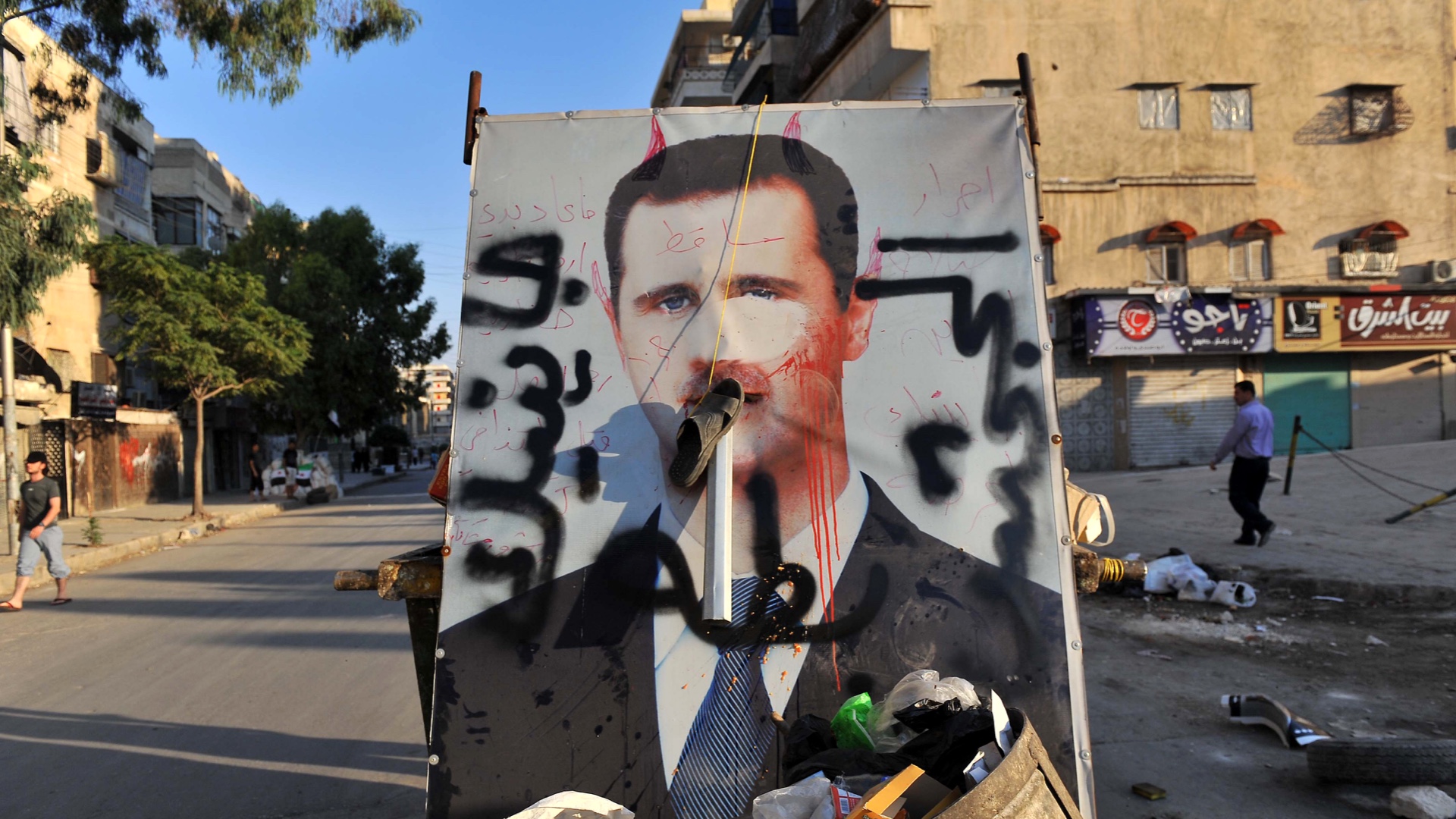

assad-mutilated

assad-mutilated

Türkiye’s economic relationship with Syria has entered a new and transformative phase, marked by a sharp rise in exports following the removal of longtime Syrian leader Bashar Assad. According to official trade data, Türkiye’s exports to Syria increased by nearly 70% in the first year after the regime change, signaling not only a revival of bilateral trade but also the emergence of a more structured and forward-looking commercial framework between the two neighbors.

The surge comes after Ankara played a central role in supporting opposition forces that overthrew Assad in early December 2024. Since then, Türkiye has openly committed itself to supporting Syria’s reconstruction, economic recovery, and reintegration into regional trade networks. Trade figures from 2025 suggest that these political and diplomatic commitments are rapidly translating into tangible economic outcomes.

Türkiye’s Exports to Syria Reach $2.57 Billion

Data compiled from the Türkiye Exporters Assembly (TIM) show that Türkiye’s shipments to Syria climbed to approximately $2.57 billion in 2025, representing a 69.6% increase compared with nearly $1.52 billion in the previous year. This dramatic rise reflects a rebound in demand across multiple sectors, particularly those linked to basic consumption needs and industrial rebuilding.

The composition of exports highlights Syria’s immediate priorities in the post-conflict period. Essential consumer goods and industrial inputs dominated trade flows, underscoring the scale of reconstruction needs and Türkiyeis role as a primary supplier.

Food and Agriculture Lead Export Growth

Among all sectors, cereals, pulses, oilseeds, and related products accounted for the largest share of Türkiye’s exports to Syria. Shipments in this category rose 35.4% year-over-year, reaching $700.1 million. This reflects strong demand for staple foods as Syria works to stabilize domestic supply chains and ensure food security after years of disruption.

Beyond agriculture, chemical and industrial goods recorded some of the fastest growth rates. Exports of chemicals and chemical products surged by 78.6% to $299.1 million, highlighting demand for materials used in manufacturing, sanitation, construction, and infrastructure repair. Similarly, electrical and electronic goods increased by 61% to $224.3 million, signaling early momentum in rebuilding energy systems, communications, and basic industrial capacity.

Trade Volumes Recover From War-Era Collapse

The latest figures also put recent gains into historical perspective. Before the outbreak of the Syrian civil war, trade between Türkiye and Syria totaled $2.3 billion in 2010. However, as conflict intensified, bilateral trade collapsed. By 2012, trade volume had fallen to just $565 million, reflecting border closures, security risks, and economic fragmentation.

Although trade gradually recovered in subsequent years, it never returned to pre-2011 levels—until now. The sharp increase recorded in 2025 suggests that the post-Assad environment has fundamentally altered the trajectory of economic relations, allowing trade to approach, and potentially surpass, earlier benchmarks.

“More Predictable and Institutionalized” Relations

Celal Kadooğlu, head of TIM’s Syria Desk and chair of the Southeastern Anatolia Cereals, Pulses, Oilseeds and Products Exporters’ Association, attributed the surge in exports to a deliberate and coordinated strategy rather than short-term opportunity.

Kadooğlu described 2025 as a turning point in bilateral commerce, saying it marked a shift toward predictability, institutionalization, and sustainability in Türkiye–Syria trade relations.

“Throughout the year, we addressed exporters’ on-the-ground needs in close coordination with public authorities. The export figures we have reached are a concrete outcome of this approach,” he told Anadolu Agency (AA).

His comments underline the role of public-private coordination, particularly in navigating logistical, regulatory, and security-related challenges in a post-conflict environment.

Trade No Longer Limited to Border Provinces

Another notable development, according to Kadooğlu, is the geographic diversification of Türkiye’s export base to Syria. Historically, trade with Syria was heavily concentrated in Türkiye’s border provinces. The latest data, however, suggest a broader national engagement.

Kadooğlu noted that Syria is increasingly being served by production centers across Türkiye, indicating deeper integration into national supply chains rather than reliance on proximity alone.

“As investments increase in the region, mutual trust and predictability are strengthening, which directly feeds into both the volume and quality of trade,” he said.

This shift suggests that exporters now view Syria not as a high-risk, short-term outlet, but as a longer-term market with expanding potential.

Regional Implications Beyond Bilateral Trade

Beyond immediate trade gains, Kadooğlu emphasized the broader strategic implications of Syria’s economic stabilization. Greater political and economic stability, he said, is helping commercial ties take root on a more durable footing and could reshape regional trade dynamics.

He added that Syria’s reintegration into regional trade networks may strengthen a wider commercial corridor linking the Middle East, Africa, and the Gulf. Such a development would position Türkiye not only as Syria’s main trading partner but also as a central logistical and production hub connecting multiple regions.