Weekly Capital Flows: CBRT reserves surge as foreign investors pile into Turkish bonds

foreign purchases 22january

foreign purchases 22january

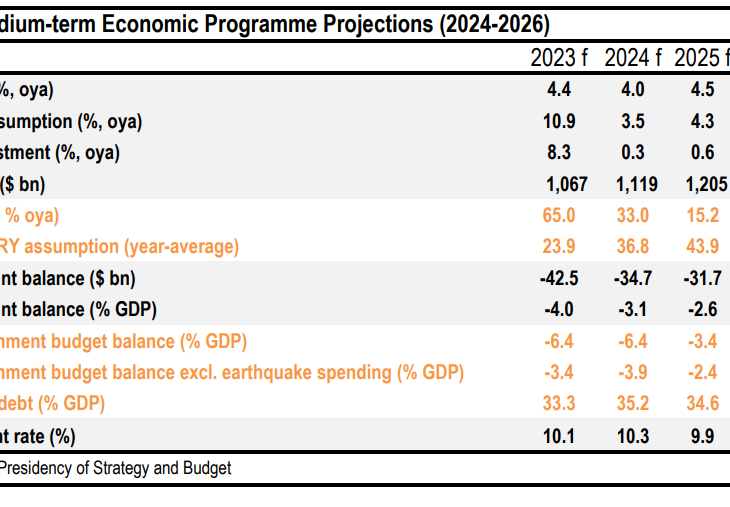

Summary:

Türkiye’s financial markets recorded a strong inflow of foreign capital in the week ending January 16, driven by a sharp rise in Central Bank reserves and robust foreign demand for government bonds. Net reserves excluding swaps climbed to fresh post-crisis highs, while the unwinding of FX-protected deposits (KKM) continued toward completion. The data point to rising investor confidence in Türkiye’s monetary normalization and macroeconomic outlook.

CBRT reserves jump to new highs

Central Bank of the Republic of Türkiye (CBRT) reserves strengthened markedly in the week ending January 16. Net reserves excluding swaps rose by $8.4 billion, or $4.0 billion when adjusted for gold price effects. Over the same period, gross reserves increased by approximately $9.1 billion, reaching $205 billion, while net reserves climbed to $90.8 billion.

According to CBRT analytical balance sheet data, reserves continued to rise into the following week. As of January 21, gross reserves were estimated to have increased by an additional $7 billion, while net reserves excluding swaps rose by roughly $4.7 billion. Gold price appreciation accounted for approximately $6.8 billion of the recent increase.

Since the start of the year, gross reserves have expanded by around $23 billion, while net reserves excluding swaps have increased by approximately $21 billion, with nearly $13 billion of that gain attributable to higher gold prices.

FX deposits rise as KKM unwinding nears completion

Foreign currency deposits (FX deposits), adjusted for parity effects, rose by $548 million during the week. Individual depositors recorded net purchases of approximately $716 million, while corporate accounts posted net sales of around $168 million. Since the beginning of 2025, total FX deposits have increased by $21.5 billion.

Meanwhile, the balance of FX-protected deposit accounts (KKM) declined by TRY 1.02 billion (approximately $24 million) to TRY 4.8 billion. The cumulative unwinding of KKM since its peak in August 2023 has reached TRY 3.4 trillion (around $136.9 billion), suggesting the scheme is close to being fully phased out.

The combined share of FX deposits and KKM in total deposits now stands at 39.3%, down sharply from a peak of 68.4% in August 2023.

TL deposits expand, credit growth moderates

Turkish lira deposits increased by TRY 446 billion on the week, reaching approximately TRY 16.7 trillion.

Foreign currency-denominated loans rose by $0.2 billion during the week and have expanded by 48% since the end of March 2024, reaching $199.5 billion.

On a 13-week annualized basis, commercial loan growth accelerated from 24.5% to 26.7%, while consumer loan growth slowed from 60.2% to 52.7%, indicating tighter financial conditions on the household side.

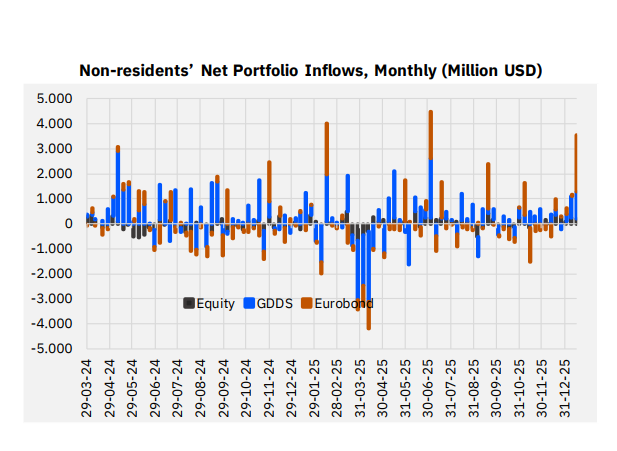

Strong foreign inflows into bonds and equities

Foreign investors made significant portfolio allocations to Turkish assets during the week. Non-residents purchased approximately $1.1 billion worth of domestic government bonds (DİBS), lifting total bond holdings to $19.2 billion. Year-to-date foreign inflows into Turkish bonds have reached $2.25 billion.

Equities also saw continued foreign interest, with $197 million in net purchases during the week. Total foreign equity holdings rose above $38.5 billion, while cumulative equity inflows over the past seven weeks reached $1.36 billion.

In addition, foreign investors bought approximately $2.28 million in Turkish Treasury eurobonds, bringing total eurobond holdings to around $85.4 billion.

Money market funds and dollarization trends

Money Market Fund (MMF) assets expanded by TRY 28 billion, surpassing TRY 1.5 trillion. MMFs under umbrella funds rose to TRY 1.2 trillion.

The total size of FX-denominated investment funds increased by $671 million to $79.7 billion, up from $25 billion at the start of 2024 and around $50 billion at the beginning of 2025.

Including investment funds, Türkiye’s dollarization ratio declined from 42.4% to 42.1% during the week. This compares with levels as high as 70% in mid-2023.

Outlook: confidence in monetary normalization strengthens

The sharp improvement in reserves, sustained foreign inflows into bonds and equities, and the near-complete exit from KKM underscore growing confidence in Türkiye’s monetary normalization process. While gold price effects continue to play a role in headline reserve figures, underlying reserve accumulation and portfolio flows suggest improving external buffers and a more stable financial environment.

Source: Gedik Investment

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/***