Borsa Istanbul Rally Lifts Aselsan Above $30 Billion Valuation in Just 10 Days

aselsan1

aselsan1

Summary:

Borsa Istanbul has kicked off the new year with one of its strongest starts in recent memory, sharply outperforming other emerging markets. The benchmark BIST 100 index has surged more than 11% in just 10 trading days, reaching a fresh record close, while defense giant Aselsan has jumped 31% to become Türkiye’s first listed company with a market value exceeding $30 billion. Investors are betting on continued disinflation, imminent rate cuts and a broader valuation catch-up in Turkish equities.

Record-Breaking Start for Borsa Istanbul

Turkey’s equity market has entered the year with strong momentum. After closing at 11,151 points on December 29, the BIST 100 climbed steadily over the following 10 trading sessions, gaining roughly 11% and setting a record closing level of 12,385 points. Intraday, the index briefly touched 12,428, marking a new all-time high.

Market participants describe the rally as one of the best January openings in recent years, driven by a combination of domestic macroeconomic factors and improving investor sentiment toward Turkish assets.

Aselsan Leads the Rally

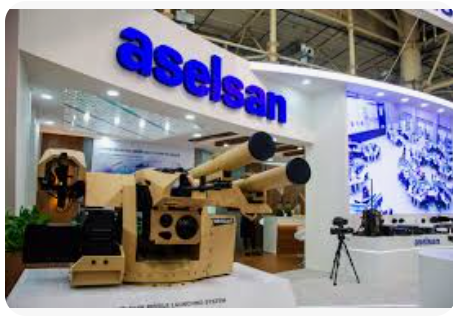

Among large-cap stocks, Aselsan has emerged as the clear standout. Shares of the defense and electronics group surged 31% over the same 10-day period, making Aselsan the top-performing stock within the BIST 30.

As of the January 13 close, Aselsan’s market capitalization surpassed $30 billion, making it the first Turkish listed company to cross that threshold. The milestone reflects not only the broader market rally but also strong company-specific fundamentals.

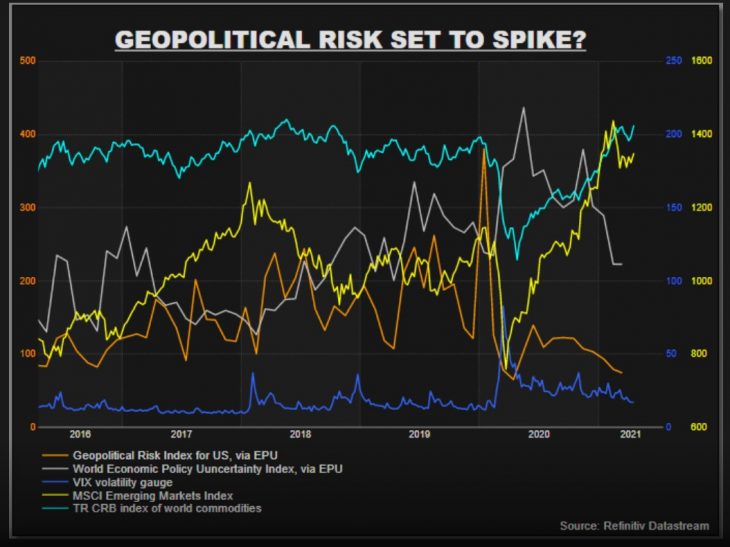

Aselsan has secured approximately $1.45 billion in new export orders over the past nine months and has climbed into the ranks of Europe’s 10 most valuable defense companies, benefiting from rising global defense spending and geopolitical tensions.

Why the Market Is Rising

The rally is being underpinned by a favorable macroeconomic narrative. Investors increasingly view disinflation as the base-case scenario for 2026 after December inflation came in below expectations. This has reinforced expectations that the Central Bank of the Republic of Türkiye will continue easing monetary policy.

Markets are now pricing in a 150-basis-point rate cut at the central bank’s January 22 policy meeting, which has fueled a rotation into equities, particularly rate-sensitive sectors.

In addition, analysts point to Türkiye’s declining sovereign risk premium as another tailwind. The steady drop in CDS spreads has improved perceptions of macro stability and reduced the risk premium demanded by both domestic and foreign investors.

Key Levels and Near-Term Risks

Despite the strong gains, analysts caution that short-term profit-taking could emerge after the rapid ascent. For the BIST 100, the 12,550 level is widely seen as a key resistance zone. A brief consolidation or pullback would not be unusual following such a sharp rally.

That said, most strategists argue that the medium- to long-term trend remains upward, provided disinflation continues and monetary easing proceeds in a measured and credible manner.

Upcoming fourth-quarter earnings reports are also expected to drive more stock-specific moves, potentially adding depth to the rally beyond index-heavy names.

BIST 30: Broad-Based Gains

The rally has not been limited to a single stock. Several heavyweight companies within the BIST 30 have posted double-digit gains since late December:

-

ASELSAN: +31.1%

-

ASTOR Enerji: +22.6%

-

BIM Birleşik Mağazalar: +21.3%

-

Türk Hava Yolları Teknik (TRALT): +19.2%

-

Migros: +17.2%

-

Tofaş: +14.4%

-

Tüpraş: +13.8%

-

Ülker: +13.7%

-

Koç Holding: +12.3%

-

Sabancı Holding: +11.4%

This broad-based performance suggests that the rally is not purely speculative, but reflects renewed confidence across multiple sectors.

Outperforming Emerging Markets

In early 2026, Borsa Istanbul has significantly outperformed global peers. While the MSCI Emerging Markets Index gained around 4.9% over the same period, the BIST 100 rose roughly 7% in local currency terms. By comparison, the S&P 500 advanced just over 1%.

Analysts attribute this divergence to a “CBRT pivot trade,” as lower-than-expected inflation and rate-cut expectations have triggered a valuation re-rating in Turkish equities.

Even after the recent rally, Turkish stocks continue to trade at a discount of nearly 20% to their historical highs in U.S. dollar terms, making them attractive to foreign investors rotating out of more expensive U.S. markets.

A Valuation Catch-Up Story

Strategists say the current move may mark the early stages of a broader catch-up cycle rather than the end of the rally. Lower interest rates, improving balance sheets and stronger export performance — particularly in defense and industrial sectors — could support further upside if macro stability is maintained.

For now, the market’s message is clear: Borsa Istanbul has re-emerged as one of the strongest-performing equity markets of the year, with Aselsan symbolizing both the rally’s momentum and Türkiye’s growing footprint in high-value industries.

Source: Turkish market data, company disclosures

***PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/***