A Hidden Hole in the Central Bank’s Vault

tcmb vault

tcmb vault

Summary:

While Turkey’s economic authorities highlight rising headline reserves at the Central Bank of the Republic of Türkiye (CBRT), a closer look at the data reveals a more troubling picture. Once the surge in gold prices is stripped out, the CBRT’s foreign-exchange reserves have in fact declined sharply, raising questions about capital outflows, the balance of payments, and the unintended consequences of gold import restrictions.

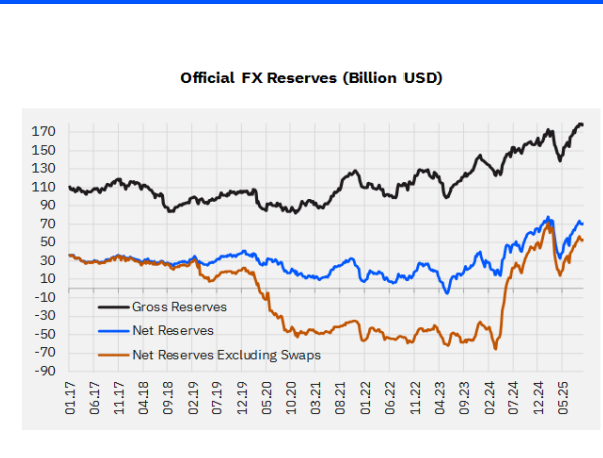

Turkey’s economic management continues to point to rising central bank reserves as evidence of policy success. Official figures show that the CBRT’s gross reserves increased by $28.9 billion in 2025, climbing from $155.2 billion at the end of 2024 to $184 billion. But this headline improvement masks a significant deterioration beneath the surface.

When the effect of rising global gold prices is excluded, reserves did not increase — they fell.

According to calculations by former CBRT executive Zafer Yükseler, the central bank’s total gold reserves rose by $48.1 billion in 2025 to reach $112.4 billion. However, roughly $43.9 billion of that increase was purely valuation-driven, reflecting higher gold prices rather than new physical accumulation.

Sharp Decline in Foreign-Exchange Assets

The distortion becomes clear when gold is removed from the equation.

CBRT data show that total foreign-currency assets excluding gold fell by $19.6 billion in 2025, dropping from $83.5 billion to $63.9 billion. Net foreign-currency assets declined by a similar magnitude, falling by $20 billion to minus $38.2 billion.

By contrast, net gold assets rose by $40.4 billion to $96 billion — again largely due to price effects rather than active reserve accumulation.

In other words, the apparent strength in reserves is almost entirely explained by gold revaluation, while foreign-exchange buffers have been eroded.

The Balance of Payments Tells the Real Story

The explanation for this erosion lies in Turkey’s balance of payments data.

According to the latest figures through October, Turkey recorded a cumulative current account deficit of $14.5 billion over the first ten months of the year. On the financing side, the country attracted:

-

$3.5 billion in net foreign direct investment,

-

$15.8 billion in net debt inflows,

-

and experienced $0.8 billion in net portfolio outflows.

In total, net recorded financing inflows amounted to $18.5 billion — more than enough to cover the current account deficit.

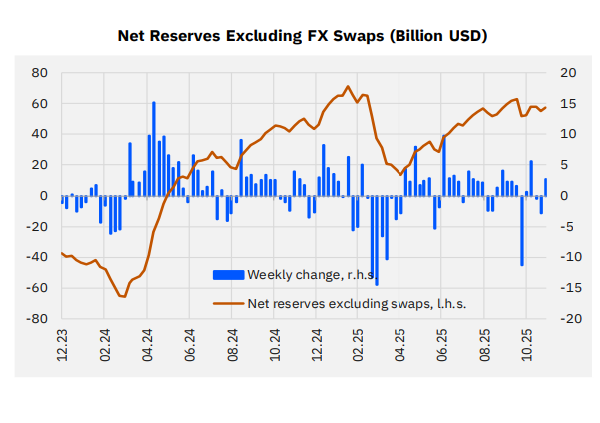

Yet despite this apparent surplus of financing, CBRT reserves declined by $13.1 billion over the same period.

The missing link is the “net errors and omissions” item — capital flows of unknown origin.

A Growing Black Hole: Net Errors and Omissions

During the first ten months of 2025 alone, Turkey recorded $15.6 billion in unexplained net capital outflows under net errors and omissions. Combined with the current account deficit, total unaccounted pressure exceeded $30 billion.

This discrepancy effectively drained reserves, offsetting recorded inflows and creating what analysts describe as a “black hole” in the central bank’s balance sheet.

Gold Import Quotas and Capital Leakage

The persistence of unexplained outflows coincides closely with Turkey’s gold import quota policy.

Since August 2023, when a quota system was introduced to curb gold imports, cumulative net errors and omissions have shown a pronounced shift. Over the 27 months following the introduction of the quota, net unexplained outflows reached $30.9 billion.

In contrast, during the 27 months before the quota was imposed, Turkey recorded $29.3 billion in unexplained net inflows.

The quota — set at 12 tons per month — was introduced after a surge in gold imports ahead of the May 2023 elections, amid financial turbulence. However, it had unintended consequences.

Following the quota’s introduction, the price gap between domestic and international gold markets widened to record levels. This arbitrage opportunity fueled a surge in gold smuggling, which experts believe contributed significantly to the spike in unrecorded capital outflows captured under net errors and omissions.

Why the CBRT Stopped Buying Domestic Gold

Amid mounting distortions, the CBRT took a notable step in mid-October: it halted gold purchases from domestic mines.

Following this decision, the price gap between domestic and international gold markets narrowed, suggesting that the policy was exacerbating market imbalances rather than stabilizing them.

Analysts argue that the combination of import restrictions, price distortions, and illicit flows undermined reserve accumulation rather than protecting it — effectively forcing the central bank to absorb the costs of a policy designed to conserve foreign exchange.

Conclusion

Turkey’s reserve story in 2025 is far less reassuring than headline figures suggest. Beneath the surface of rising gross reserves lies a sharp decline in foreign-exchange assets, masked by a gold price windfall and accompanied by unusually large unexplained capital outflows.

The data point to structural weaknesses in capital flow management and highlight the risks of policy tools that distort markets. Without addressing the underlying drivers of net errors and omissions, reserve accumulation may remain vulnerable — regardless of how high gold prices climb.

IMPORTANT DISCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English YouTube channel (REAL TURKEY):

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel — https://www.facebook.com/realturkeychannel/