Türkiye’s Disinflation Back on Track After Latest Rate Cut, CBRT Chief Says

fatih karahan5

fatih karahan5

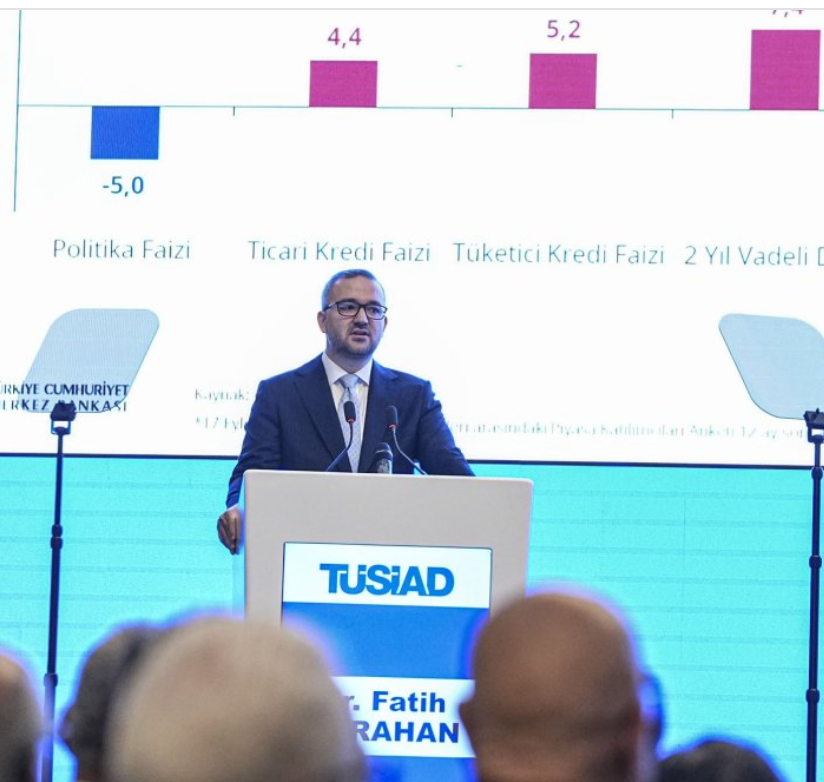

ANKARA — Türkiye’s disinflation trend remains intact and is set to continue in the months ahead, Central Bank Governor Fatih Karahan said on Friday, defending the monetary authority’s latest interest-rate cut despite lingering concerns over inflation dynamics.

Speaking at the Turkish Industry and Business Association (TÜSİAD) High Advisory Council meeting in Ankara, Karahan said that both short-term indicators and the medium-term outlook confirm that the disinflation process “is continuing and will continue,” following Thursday’s 150-basis-point reduction in the policy rate to 38%.

“Disinflation Will Continue”

Karahan noted that private consumption — which had expanded at historically high rates during the inflation surge — has begun to slow. Household inflation expectations, he added, are also declining.

He reiterated that the Central Bank of the Republic of Türkiye (CBRT) will tighten policy if the inflation outlook deviates from its interim targets.

Data released this month showed consumer inflation easing to 31.1% year-on-year in November, with the monthly increase of 0.87% coming in lower than expected on the back of falling food prices. Inflation had exceeded forecasts in August and September but undershot them in October and November.

The November reading marked the lowest annual inflation rate since late 2021, down sharply from the peak of 75% seen in May 2024.

Mixed Sectoral Progress on Inflation

Karahan highlighted uneven progress across inflation components.

-

Core goods inflation has fallen below headline levels, dropping to below 19%.

-

Food inflation remains volatile.

-

Services inflation is still elevated at around 44%, driven by rents and education costs.

Despite this, Karahan stressed that compared with the May 2024 peak, inflation has improved “in every category,” citing declines of 38 points in core goods, 43 points in food, and 52 points in services.

He also pointed to easing cost pressures: producer inflation has fallen to 27%, while cost inflation in services industries has dropped significantly. In construction, input-cost pressures have also weakened.

How Much Will the CBRT Cut Rates in 2026? Brokerages Split After Surprise Move

Credit Conditions and Market Rates

Karahan emphasized that the CBRT’s policy rate influences mostly short-term funding conditions, while longer-term loan rates depend more on inflation expectations and uncertainty.

Despite a cumulative 650-basis-point easing cycle prior to the latest cut, both commercial and consumer loan rates have declined meaningfully. Improving inflation expectations have also helped bring down bond yields.

Longer loan maturities — critical for investment activity — are slowly increasing, and Karahan said the CBRT expects maturities to continue lengthening as confidence in disinflation grows.

Policy Outlook

Karahan reiterated that future policy steps will be determined “on a meeting-by-meeting basis” and remain strictly data-dependent.

“If the inflation outlook deviates meaningfully from interim targets, we will tighten monetary policy,” he said. “Price stability is a precondition for sustainable growth and social welfare. We will do whatever is necessary to achieve it.”

The CBRT’s targets foresee:

-

13–19% inflation in 2026

-

16% intermediate target for end-2026

-

24% year-end target for 2025

Analysts expect additional rate cuts next year, though at a gradual pace.

PA Turkey Standard Disclaimer (Live Links)

IMPORTANT DISCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/