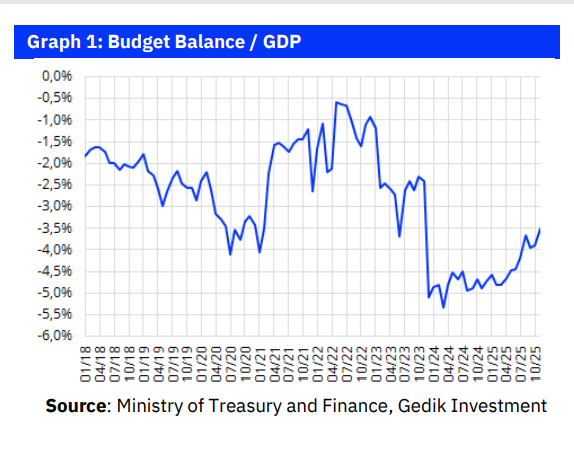

Türkiye’s Cash Budget Strengthens in November as Deficit Continues to Narrow

dollar

dollar

Türkiye’s latest cash budget data from the Ministry of Treasury and Finance shows a notable improvement in fiscal performance. After recording a 62 billion TL deficit in November 2024, the cash budget posted a 56 billion TL surplus in November 2025. The main driver behind this reversal was that expenditure growth remained lower than revenue growth, helping the 12-month rolling deficit shrink by 119 billion TL, reaching 2.101 trillion TL.

During January–November, the cash budget deficit remained almost unchanged compared with the previous year. According to the Medium-Term Program (OVP), the central government budget deficit is expected to reach 2.208 trillion TL by year-end. Assuming that the cash and central budget balances converge, the December cash deficit must increase by less than 33% for the annual target to be met. Given the current trajectory, analysts expect Türkiye to achieve its 2025 budget target. Under the OVP, the budget deficit-to-GDP ratio is forecast at 3.6% for 2025 and 3.5% for 2026.

Limited Increase in Treasury Cash Position

In November, cash-based revenues increased 37% year-on-year on a three-month rolling basis, while expenditures rose 33%. Non-interest expenditures climbed 34%, and interest payments increased 27%, reinforcing the improvement in fiscal balances.

The domestic debt rollover ratio came in at 150%, exceeding the Treasury’s monthly program projection. The 12-month ratio eased slightly from 137% to 136%. According to the Ministry’s projections, domestic rollover ratios for December 2025–February 2026 will average 94%, well below the 2026 full-year estimate of 106%.

Treasury cash balances saw only a mild increase in November. Based on Central Bank data, the public sector’s FX deposits decreased by 2 billion TL (0.1 billion USD), while TL deposits rose by 10 billion TL. The Treasury ended November with a total cash balance of 1.166 trillion TL, comprising both FX and TL deposits. FX deposits within the Treasury’s account amounted to approximately 11.3 billion USD.

December Debt Payments Expected to Be Light

Domestic debt payments in December are projected at 110 billion TL, falling well below the average monthly debt service for the upcoming 12-month period. Heavier domestic repayments are expected in January, February, April, June, July, and August. Notably, January and February each include around 590 billion TL in domestic debt redemptions—the highest monthly burden of the year.

Markets are also watching for the Central Bank of Türkiye’s annual report in December, which is expected to clarify the Bank’s 2026 government bond purchase program.

As of October 2025, the share of non-TL debt within domestic debt stock remained steady at 20%, matching the previous month.

External debt payments will also be light in December, totaling just 0.4 billion USD, below the 12-month average. However, sizeable repayments are scheduled for January (3.0 billion USD), February (2.6 billion USD), April (2.1 billion USD), June (2.9 billion USD), and October (3.6 billion USD).

Türkiye’s international borrowing for 2025 has already reached 13 billion USD, surpassing the program target of 11 billion USD. For 2026, the Treasury plans to borrow 13 billion USD from international markets under its new financing program.