Turkish Economy Q3 GDP Analysis: Consumption Stays Robust Despite Tight Monetary Policy

gsyh 3c2

gsyh 3c2

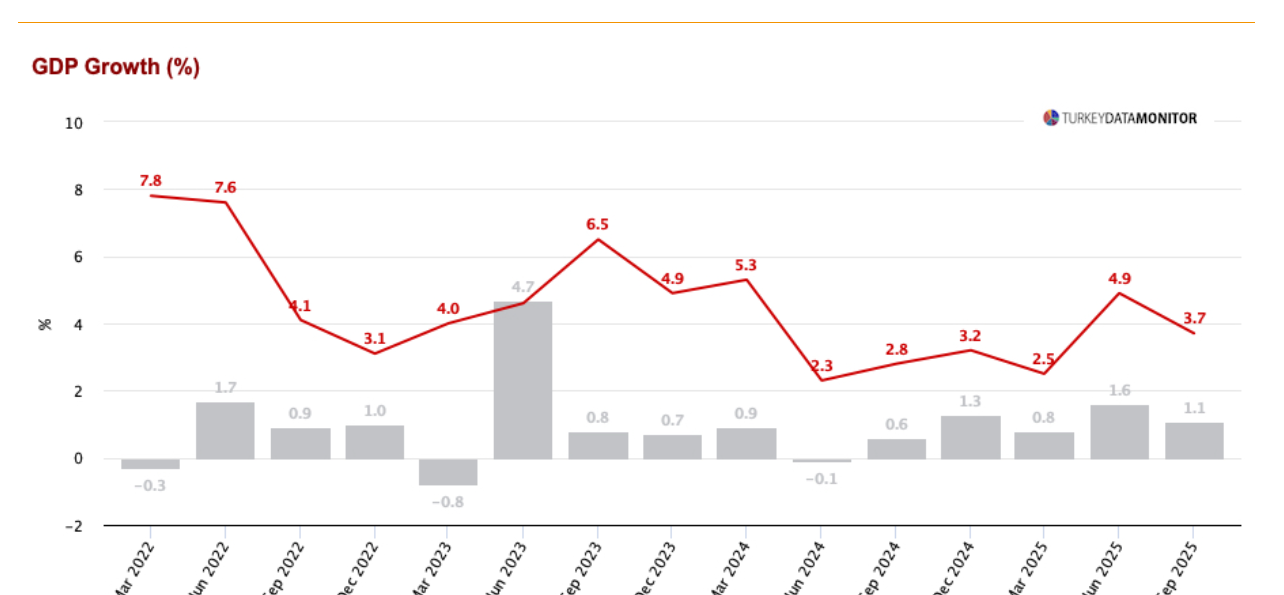

Domestic Demand Defies Cooling Measures as GDP Hits 3.7% YoY

Turkey’s Gross Domestic Product (GDP) grew by 3.7% year-on-year (YoY) in the third quarter of 2025, according to data released by the Turkish Statistical Institute (TÜİK). While this figure was slightly below market expectations (which ranged between 3.9% and 4.2%), the growth composition highlights a continued reliance on strong domestic demand, raising questions about the effectiveness of the central bank’s efforts to cool the economy.

Key Drivers: Investment and Strong Consumption

The moderate growth came primarily from resilience in household spending and a sharp uptick in investment:

-

Household Consumption: Private consumption expenditures grew by a powerful 4.8% YoY, contributing approximately 3.2 percentage points to the headline growth. This strong momentum—following a strong Q2—continues to contradict the Central Bank of the Republic of Turkey’s (TCMB) rhetoric on the rebalancing of domestic demand. Seasonally and calendar-adjusted data showed a 2.1% increase quarter-on-quarter, reinforcing the lack of significant cooling.

-

Investment Surge: Gross fixed capital formation (investment) was exceptionally strong, rising by 11.7% YoY, contributing 2.8 percentage points to GDP growth. This surge was led by robust growth in construction investments (13.3%) and machinery and equipment investments (11.3%).

-

Net External Demand: The external sector was a drag on growth, subtracting about 1.0 percentage point from the headline figure, as exports contracted slightly (-0.7%) while imports increased (4.3%).

Sectoral Breakdown: Agriculture Contracted Heavily

Looking at the production side, the performance was uneven:

-

Weak Agriculture: The agriculture sector experienced a sharp contraction of 12.7%, which experts note pulled headline GDP down by around 1.3 percentage points. Akbank Economic Research calculates that the non-agricultural GDP grew by a much stronger 5.6% YoY, suggesting that supply-side issues in agriculture are masking the true underlying strength of domestic activity.

-

Leading Sectors: The construction sector remained robust, expanding by 13.9% YoY, largely supported by post-earthquake reconstruction spending. The services sector also maintained momentum with a 6.3% growth rate, led by finance and insurance (10.8%) and information and communication (10.1%).

-

Industrial Activity: The industry sector grew by a strong 6.5%, though this performance is largely attributed to a low base effect from the previous year.

Outlook: TCMB, Rates, and Full-Year Forecast

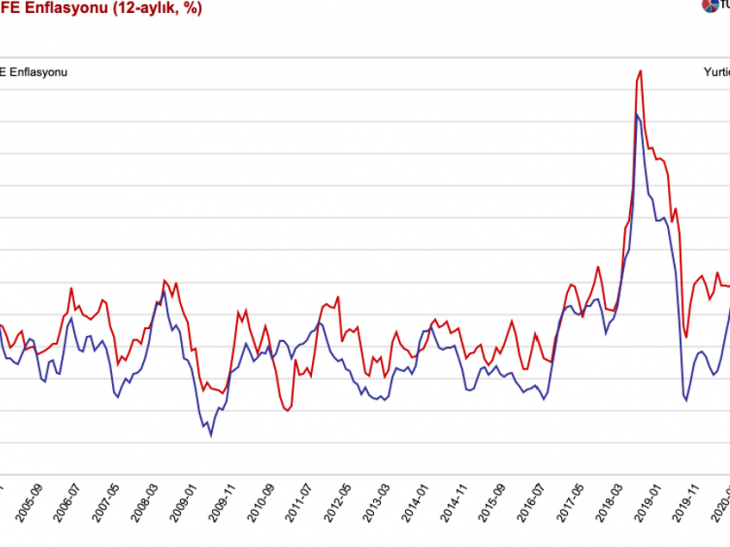

Investment firms concur that the strong domestic activity is not consistent with the TCMB’s desired disinflation path:

“The robust consumption trend in Q3, combined with accelerated activity in non-agricultural sectors, makes it difficult for the TCMB to significantly increase the pace of rate cuts in December.”

-

Rate Expectation: Despite the strong activity, the market is still pricing in a rate cut of 100-150 basis points (bps) from the TCMB, driven primarily by favorable forecasts for November inflation. However, the strong underlying economic momentum suggests that large rate cuts could hurt the central bank’s credibility in fighting inflation.

-

Full-Year Forecast: Analysts generally expect the GDP growth for the full year 2025 to land slightly above 3.5%. The easing of global uncertainty is anticipated to keep the current account deficit under check and align year-end growth with the targets set in the Medium-Term Program (OVP).

Al Baraka Invest, Akbank, Gedik Invest