Turkey’s Real Sector Is Flashing Red — Rising Bankruptcies, Debt Stress and a Surge in Zombie Firms

is dunyasi stress

is dunyasi stress

By Sevket Sayilgan, Ekonomist, DUNYA Gazette

Turkey entered 2025 with moderate headline growth, but beneath the surface the real sector is deteriorating rapidly. Bankruptcies are rising, liquidity is tightening, profit margins are collapsing, and one-third of all firms can no longer cover their interest expenses. As credit costs surge and the lira remains artificially supported through reserves, companies are increasingly trapped in a debt rollover cycle — pushing the economy toward a fragile and potentially dangerous 2026.

A Slowing Economy Masking Deep Micro-Level Stress

Official data show Turkey’s economy grew around 3.1% in the first nine months of 2025, down from 4.5% the previous year. While this appears to be a “moderate slowdown,” the micro-level data tell a very different story:

-

The number of shuttered businesses rose 19%,

-

Firms entering liquidation climbed 12%,

-

41% of real-sector debt is now short-term,

-

Profitability and cash flow continue to erode.

With economic management prioritizing price stability, the burden of financial instability is falling squarely on producers.

High Interest Rates vs. Real Sector Survival

The Central Bank of Turkey has started to signal limited easing, but as of October 2025 the policy rate still stands at 39.5% — only 5.5 points below last year’s peak, and still above annual inflation (37.8%). Real rates remain positive, tightening financing conditions.

Credit Costs Are Crippling Businesses

-

Average commercial loan rate: 49.7%

-

SME loan rate: 53.2%

-

Average loan maturity: 9.4 months

-

Average collateral requirement: 128%

As access to credit narrows, companies have been forced into a “debt to pay debt” spiral. Financing costs have become production costs, wiping out profit margins — especially in sectors dependent on imported inputs.

The gap between the government’s inflation targets and market expectations has widened dramatically. While the CBRT foresees 29% inflation in 2025 and 19.9% in 2026, market surveys expect 25–28% inflation in mid-2026 — a 15-point expectations gap.

Exchange Rate Stability Masked by Heavy Intervention

The lira appears stable, with 2025 averages around:

-

USD/TRY 39.10

-

EUR/TRY 41.85

-

Basket rate: 40.47

But reserves tell the real story:

-

Gross reserves: $163.8 billion

-

Net reserves excluding swaps: –$7.5 billion

The lira’s stability is largely intervention-driven.

For the real sector, the FX backdrop is far more dangerous:

-

Turkey’s external debt: $487 billion

-

Real sector net FX short position: $84.6 billion

-

Short-term share of FX debt: 47%

Every 1 TL depreciation adds roughly 84.6 billion TL to firms’ liabilities. As a result, exporters are using 60% of foreign-currency earnings to service debt rather than fund production.

Zombie Firms: A Growing and Hidden Layer of the Economy

The number of unprofitable firms surviving solely on new loans is accelerating. According to TÜSİAD (September 2025):

-

34.2% of companies cannot cover interest expenses

(vs. 21.8% in 2022) -

Most are SMEs

-

Net profit margins: below 1%

-

30–35% of operating income goes to financing costs

-

Zombie firms employ 22% of Turkey’s labor force

This means one in every five workers is employed by a financially unsustainable business, eroding productivity even as GDP appears to grow.

Regional and Sectoral Fragmentation

Turkey’s industrial map shows a deepening divide:

-

Northwest (Istanbul–Bursa–Kocaeli–Sakarya): automotive, metals → contracting

-

Aegean (Izmir–Denizli–Manisa): textiles, food processing → shrinking capacity

-

Central & Southeastern Anatolia (Konya–Kayseri–Gaziantep): domestic-market producers → more resilient

A Hidden Rise in Unemployment

Official unemployment stands at 8.8%, but broad unemployment — including discouraged workers and under-employment — is 22.1%.

Over the past six months:

-

Industrial employment fell by 63,000,

-

Largest declines:

-

Textiles: –18,000

-

Metals: –15,000

-

Construction: –12,000

-

Retail: –8,000

-

For the first time, social-security-registered employment fell for three consecutive quarters. Without short-time work or income-support mechanisms, job losses have translated directly into income losses.

Banking Sector: Controlled but Fragile

Total loan volume: 11.2 trillion TL, of which 6.9 trillion is commercial loans.

-

NPL ratio: 3.8%

-

Including restructured loans: 11.5%

-

SME overdue rates: 7.2%

-

Large industrial firms: 4.1%

Banks increasingly prioritize balance-sheet strength over interest rates when evaluating borrowers, making credit not only expensive but selective. Payment delays now ripple through supply chains:

Average commercial receivable turnover has risen to 103 days (from 78 days in 2022).

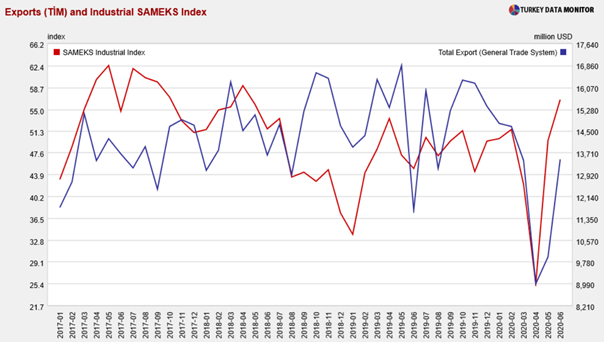

Exports: Underperforming Despite Stable FX

2025 exports: $246.7 billion

2025 imports: $290.4 billion

Trade deficit: $43.7 billion

Sluggish growth in Europe (0.6% in 2025) has led to weakening orders from Turkey’s main markets. While Gulf, African and Central Asian markets are expanding, they represent only 16% of exports.

The real effective exchange rate (REER) at 58.3 suggests the lira remains overvalued, weakening export competitiveness as domestic costs rise.

Outlook for 2026: A Delicate Transition

Economists view 2026 as a structural transition year, assuming:

-

Gradual CBRT rate cuts,

-

Continued fiscal discipline,

-

Exchange-rate stability.

Forecasts:

-

Growth: 3.8%

-

Inflation: 25%

-

USD/TRY: 51

But this outlook depends on three major risks not materializing:

-

A deeper credit contraction

-

A collapse in domestic demand

-

Loss of FX stability

Potential opportunity areas:

-

Green transformation investments

-

Renewable energy and efficiency projects

-

Expansion into Middle East & Africa markets

-

Digitalized supply chains and e-export growth

A Growing Economy Without Real Vitality

Turkey’s 2025 economy sits on the thinnest possible line between growth and contraction. Headline figures appear stable, but the real sector is bleeding:

-

Profitability is collapsing

-

Debt is rising

-

Access to credit is shrinking

Without structural reforms, this silent deterioration could become an open crisis in 2026. The real sector is no longer just an economic pillar — it is a social stability pillar.

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY and content at Twitter: @AtillaEng.

Facebook: Real Turkey Channel.