Turkey’s Budget Deficit Rises to TL 223 Billion in October as Spending Pressures Mount

budget oct2025

budget oct2025

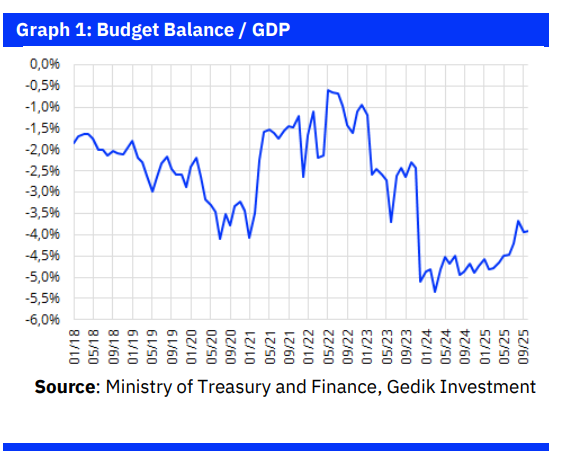

Turkey’s central government budget posted a TL 223.2 billion deficit in October, widening by nearly 20% year-on-year as strong tax collection failed to offset rapid growth in non-interest expenditures and elevated interest costs. While the primary balance showed improvement on a year-to-date basis, overall deficit dynamics remain under pressure. Economists say the government’s 2025 medium-term target—keeping the budget deficit at 3.6% of GDP—remains attainable but will require strict spending discipline.

Headline Deficit Widens Despite Strong Revenue Performance

Turkey’s central government budget recorded a TL 223.2 billion deficit in October 2025, compared with TL 186.3 billion in the same month last year. The annual deterioration of 19.8% reflects higher spending—particularly current transfers and personnel costs—despite a sharp acceleration in tax revenues.

The primary deficit reached TL 65.8 billion in October, wider than the TL 50.1 billion recorded last year.

On a 12-month rolling basis:

-

The overall deficit increased slightly from TL 2.25 trillion to TL 2.29 trillion,

-

The primary deficit widened to TL 245 billion.

Tax Revenues Surge, Led by Income Tax and VAT

Budget revenues climbed 49.1% year-on-year to TL 1.147 trillion in October, supported by strong domestic demand and base effects.

Tax revenues were the key driver, rising 51.6% on an annual basis.

Biggest Contributors

-

Income tax: +90% YoY — boosted heavily by rising withholding on deposits and investment funds.

-

Domestic VAT: +52.3% YoY — signaling continued strength in consumption.

-

Imported VAT: +33.1% YoY

-

Special Consumption Tax (ÖTV): +33.9% YoY

Non-tax revenues rose 28.3% during the month, with sizeable contributions from fees, fines, and profit transfers.

Expenditures Outpace Inflation

Total expenditures increased 43.4% in October—outpacing the 32.9% annual inflation rate.

Primary Spending Climbs

Non-interest expenditures surged 48%, driven by:

-

Current transfers: +48.6% YoY

-

Personnel costs: +37.8% YoY

-

Capital expenditures: +27.9% YoY

Borrowing-related lending costs declined by 3%, providing a modest offset.

Interest Costs Still a Heavy Burden

Although the pace of increase in interest payments slowed to 15.6% YoY in October, the January–October picture remains challenging:

-

2024 Jan–Oct interest expenditures: TL 1.05 trillion

-

2025 Jan–Oct interest expenditures: TL 1.82 trillion

-

Annual increase: 74%

Rising interest costs continue to erode the fiscal benefits generated by strong tax collection.

Primary Balance Shows Notable Improvement in 2025

Despite October’s monthly deterioration, the January–October period offers a more constructive picture:

-

In 2024, the primary balance showed a TL 211 billion deficit.

-

In 2025, the same period produced a TL 379 billion primary surplus.

This improvement is largely driven by:

-

Robust revenue growth (tax revenues +51% YoY)

-

Controlled increases in primary spending (+38% nominal)

However, the improvement in the primary balance has not been sufficient to offset the surge in interest expenditures, resulting in a higher headline deficit year-to-date (TL 1.44 trillion vs. TL 1.26 trillion last year).

Medium-Term Outlook: OVP Target Still Within Reach

The government’s 2025 Medium-Term Program (OVP) revised the year-end budget deficit forecast from 3.1% to 3.6% of GDP.

Economists from major institutions such as İş Bankası, Vakıf Yatırım, and Gedik Yatırım agree that:

-

The 3.6% ratio appears realistic based on the first ten months of fiscal performance.

-

The key risk for 2025 and beyond is non-interest expenditure growth, particularly current transfers and personnel costs.

-

Additional tax adjustments cannot be ruled out for 2026, given the discrepancy between expected tax revenue growth (28%) and the GDP deflator (19.7%).

Analysts also expect the divergence between accrual-based and cash-based budget data—driven partly by delayed deployment of earthquake-related spending—to persist for some time.

What to Watch Going Forward

-

Trajectory of interest costs: largest drag on fiscal performance

-

Strength of domestic demand: affects VAT, ÖTV, and income tax revenues

-

Public spending discipline: essential for meeting deficit and inflation goals

-

EV, energy, and import tax adjustments: potential revenue sources

-

Implementation of public savings program: key to containing non-interest spending

Despite fiscal headwinds, analysts highlight that Turkey has begun to re-establish a more disciplined primary balance, though maintaining this trend will require tighter control of expenditure growth.

Turkish brokerage reports

IMPORTANT DISCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles on our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English-language YouTube videos @ REAL TURKEY, Twitter @AtillaEng, and Facebook Real Turkey Channel.