Istanbul’s Grand Bazaar Raids: 26 Arrested as Money Laundering Probe Expands Ahead of FATF Review

operasyon kapalıcarsi

operasyon kapalıcarsi

Turkish prosecutors have detained 76 people and arrested 26 in a sweeping money laundering probe centered on Istanbul’s Grand Bazaar, amid a wider crackdown on illicit funds and digital payment networks before a crucial FATF inspection.

The Istanbul Chief Public Prosecutor’s Office has expanded its investigation into an alleged multi-layered money laundering network operating through currency exchange offices in the Grand Bazaar, one of the world’s oldest and busiest financial hubs.

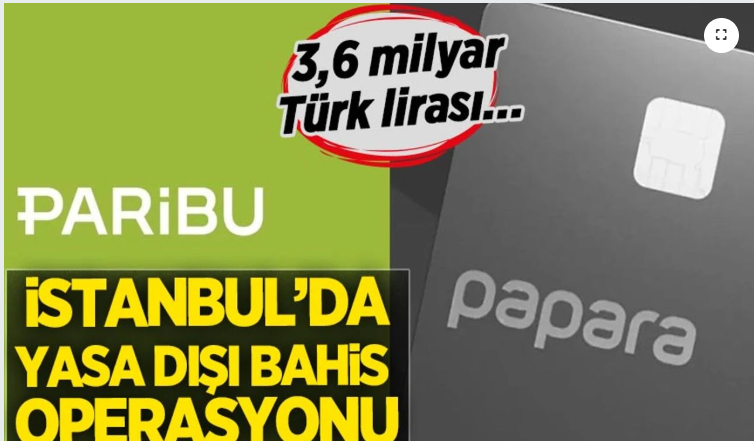

Authorities say proceeds from illegal betting, forex investment fraud, and cyber scams were funneled through front companies and individual accounts, then laundered via foreign exchange bureaus, banks, e-money firms, and crypto platforms.

The operation — one of Turkey’s largest financial crime investigations in years — led to 76 detentions and 26 arrests, with assets worth 335 million lira ($10.3 million) seized, including 31 vehicles and 74 properties.

The Grand Bazaar at the center of a laundering network

Investigators allege that criminal groups used the Grand Bazaar’s bustling currency trade to disguise illicit funds as legitimate exchange transactions.

The Financial Crimes Investigation Board (MASAK), which led the forensic audit, found evidence of a coordinated structure linking foreign exchange desks to shell firms and crypto intermediaries.

A senior finance official described the system as “a professional laundering ring that turned the Grand Bazaar into a shadow banking corridor.”

The investigation has widened to include Hotto Software Trade Inc. and Coinvest Liz Bilişim Inc., two fintech companies accused of facilitating layered digital transfers for offshore clients.

FATF visit heightens pressure on Ankara

The raids come just weeks before a scheduled on-site visit by the Financial Action Task Force (FATF), which will reassess Turkey’s compliance with global anti–money laundering (AML) and counter-terrorist financing (CTF) standards.

Turkey was removed from the FATF “grey list” in mid-2024 after a two-year reform process, but regulators remain under scrutiny for weak enforcement and gaps in financial oversight.

Officials familiar with the matter told PA Turkey that the Kapalıçarşı raids, along with recent inspections of crypto exchanges and digital payment companies, are part of a coordinated effort to demonstrate compliance before the FATF evaluation.

“Turkey is clearly trying to show the FATF that it is serious about enforcement, not just legislation,” one financial crime expert said. “The Grand Bazaar investigation is a symbolic and strategic move.”

Crypto platforms and e-money firms also targeted

In parallel with the Grand Bazaar probe, law enforcement units raided several crypto exchanges and licensed payment companies in Istanbul and Ankara.

Officials say the same laundering networks used crypto wallets, offshore stablecoins, and local e-money gateways to circulate illegal profits from betting and investment fraud.

According to MASAK, hundreds of transactions tied to these schemes were conducted through unregistered or loosely supervised payment intermediaries, making them difficult to trace.

The agency is reportedly coordinating with the Capital Markets Board (SPK) and Banking Regulation and Supervision Agency (BDDK) to review compliance lapses and potential license suspensions.

Prosecutors: “Multi-layered, organized laundering scheme”

In an official statement, the Istanbul Chief Prosecutor’s Office said the investigation builds on three previous operations, describing the latest as “the fourth and broadest phase.”

The statement confirmed that MASAK reports identified systematic use of real persons, shell companies, and digital intermediaries to conceal the origins of criminal proceeds.

“The investigation into laundering assets derived from crime, illegal betting, and fraudulent investment activities continues comprehensively and decisively,” the statement said.

The prosecutor’s office confirmed that 12 suspects remain at large, with arrest warrants issued, while courts imposed judicial control measures on 36 others.

Financial opacity under scrutiny

Analysts say the Grand Bazaar probe highlights long-standing concerns about informal financial channels and limited transaction monitoring in Istanbul’s traditional exchange markets.

Experts also note that, despite regulatory improvements, Turkey’s reliance on physical cash and high-volume FX trade still poses significant AML risks — a point likely to feature in the FATF’s upcoming review.

“Kapalıçarşı remains a hub for legitimate commerce, but its opacity makes it vulnerable to misuse,” said one compliance specialist. “These raids are as much about optics as they are about enforcement.”

Bottom line: Symbolic crackdown before global audit

The Grand Bazaar raids mark a symbolic intersection between local enforcement and international scrutiny.

By targeting both traditional currency networks and new digital intermediaries, Ankara appears determined to demonstrate that it has moved beyond the cosmetic reforms that characterized its earlier FATF compliance efforts.

As one financial official put it:

“The FATF wants results, not promises — and Turkey is trying to deliver them before inspectors land.”

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English-language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

Twitter: @AtillaEng

Facebook: Real Turkey Channel