TURKEY/Weekly Financial Developments: Resilience in Reserves and Strong Foreign Flows

cbrt reserves 13 nov

cbrt reserves 13 nov

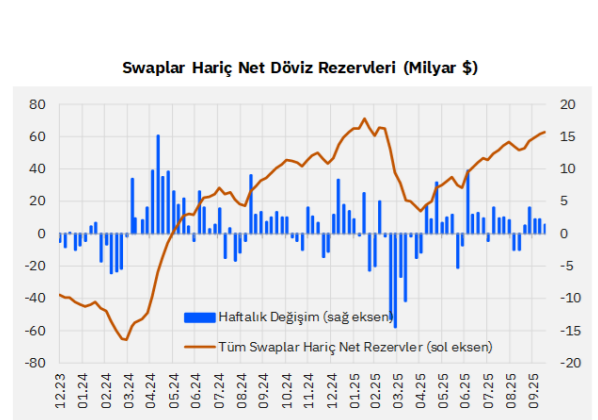

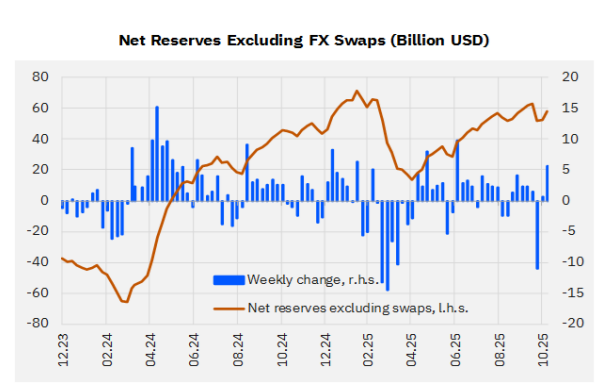

The week of November 7–12 marked a period of significant positive momentum in Turkey’s external accounts and non-resident interest, largely masking internal valuation effects. The Central Bank’s net reserves excluding swaps saw a robust increase of approximately $5.6 billion in the reporting week (November 7), pushing the stock to $58.3 billion. This recovery was reinforced by substantial purchases of Eurobonds and GDDS by non-residents. Domestically, the managed unwinding of the FX-protected deposit (KKM) scheme continued, shrinking by nearly $1 billion, even as overall dollarization ratios remain under close scrutiny.

Reserve Dynamics and Valuation Headwinds

The Central Bank of the Republic of Turkey (CBRT) reported a strong increase in reserve figures for the week ending November 7:

- Gross International Reserves rose by $1.4 billion to $185 billion.

- Net Reserves increased by $3.9 billion to $73.2 billion.

- Net Reserves Excluding Swaps increased by approximately $5.6 billion to $58.3 billion. (The CBRT’s low point for this metric was -$65.5 billion at the end of March 2024, with the previous peak at $71 billion on February 14, 2025.)

It is critical to note the impact of gold prices on these figures. Between October 17 and November 7, the total decline in gross, net, and net reserves ex-swaps included a significant $8.1 billion negative valuation impact due to falling gold prices.

For the estimated data as of November 12 (covering the first three business days), while net reserves excluding swaps showed an estimated increase of $130 million, the gold price effect was positive by roughly $3.4 billion. Accordingly, excluding this gold-price impact, net reserves ex-swaps actually indicated a decline of approximately $3.2 billion for that truncated period.

Deposit Trends and the KKM Unwinding

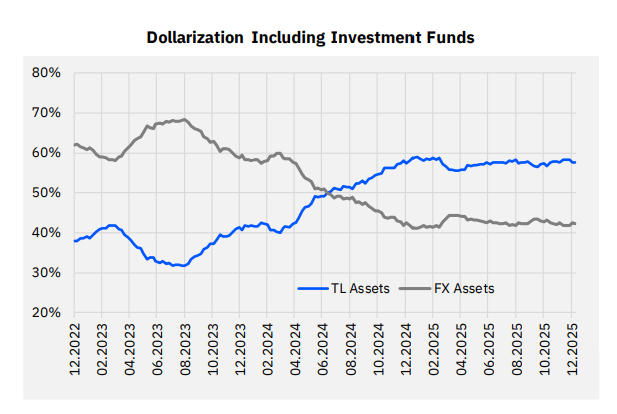

The de-dollarization effort continued, driven primarily by the steady reduction in the FX-protected deposit (KKM) scheme.

FX-Protected Deposit (KKM)

- KKM Balances decreased by TRY 37.6 billion (approximately $0.9 billion) during the week, falling to TRY 93.8 billion.

- The cumulative unwinding from the August 2023 peak has now reached TRY 3.3 trillion (or $134.7 billion).

Currency and Total Deposits

- Parity-Adjusted FX Deposits decreased by a total of $625 million, driven by significant $824 million in sales by corporates, which offset $199 million in purchases by households. Since the start of the year, FX deposits have cumulatively increased by $19 billion.

- TRY Deposits decreased by TRY 339 billion, falling to roughly TRY 15 trillion.

- The combined share of FX deposits + KKM in total deposits stood at 40.2%. This is a significant drop from the peak of 68.4% recorded in August 2023 when KKM balances were highest, indicating progress in de-dollarization.

- Including investment funds, the dollarization ratio rose slightly from 42.6% to 43.2% in the week of November 7, though this remains far below the mid-2023 peak of 70%.

Capital Flows and Non-Resident Activity

Foreign investor confidence in Turkish assets remained robust, with strong net inflows across fixed-income and Eurobond markets.

- GDDS (Government Domestic Debt Instruments): Non-residents purchased approximately $312 million in GDDS, raising the total stock to around $15.9 billion. Since the beginning of May, there has been a cumulative inflow of about $7.2 billion, recovering most of the $9.3 billion outflow seen earlier in the spring.

- Equities: Following four weeks of outflows, non-residents recorded $278.5 million in net purchases over the last two weeks, bringing the stock to around $32.4 billion.

- Eurobonds: Approximately $1.3 billion in net purchases were recorded, raising the stock to $83.7 billion.

Credit Market Snapshot

Overall credit growth trends show a continued moderation in consumer lending, while commercial lending maintains a more stable, though still robust, pace.

- FX Loans increased by $0.4 billion weekly, continuing a strong growth trend. Since the end of March 2024, FX loans have grown by 45%, reaching $194.7 billion.

- Loan Growth (Annualized 13-Week Average):

- Commercial Loans increased slightly from 20.4% to 20.8%.

- Consumer Loans continued to moderate, declining from 48.8% to 46.9%.

PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/