Turkish Central Bank Undermines Confidence with Shifting Inflation Targets, Says Dr. Cüneyt Akman

credibility

credibility

Economist Slams TCMB for Eroding Public Trust, Questions Sustainability of Currency Policy

Dr. Cüneyt Akman, a prominent economist, has delivered a sharp critique of the Turkish Central Bank’s (TCMB) latest Inflation Report, arguing that the institution’s credibility is being severely damaged by continuously missed and revised targets. Speaking on the “Para Analiz” program, Akman’s central argument was that the TCMB is failing to manage public expectations—the very core of a successful inflation-targeting regime.

Credibility Crisis at the Central Bank

Akman stressed that the success of Turkey’s inflation targeting system hinges on the Central Bank’s ability to persuade the public and investors to align their expectations with official targets. The recent report, however, has made that goal nearly impossible:

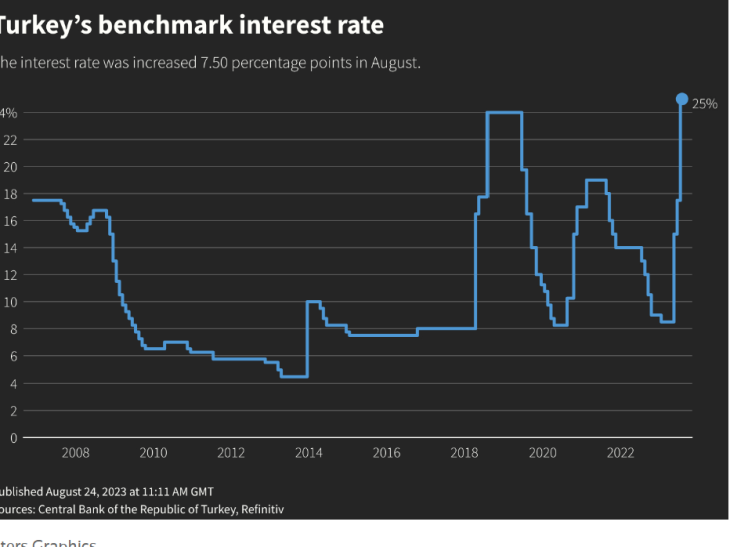

- Target Instability: The TCMB significantly revised its 2025 year-end inflation forecast range from 25%-29% to an elevated 31%-33% in just 2.5 months. Akman labeled this dramatic 6-point increase as “unbelievable,” asserting that such rapid and substantial changes destroy the bank’s function as a reliable anchor for expectations.

- Blaming the Public: Akman pointed out the irony of the TCMB potentially blaming the public for “failing to fix their expectations” as a justification for persistent inflation. He argued that when citizens lose faith in the bank’s forecasts due to continuous revisions, monetary policy loses its efficacy.

Policy Challenges and Market Warnings

The economist also challenged the bank’s explanations for prolonged high inflation and offered a cautious outlook for the coming years:

- Monetary Transmission: Akman dismissed the official claim that a lack of “monetary transmission mechanisms” hindered immediate disinflation. He argued that the financial mechanisms exist but were fundamentally damaged by previous policy mistakes, not by their non-existence.

- Upcoming Policy Reversal: Despite the current commitment to tightening, Akman forecasts an inevitable shift toward looser policy driven by political cycles, particularly local elections. He warns that the current tactic of controlling inflation by keeping the Turkish Lira strong in real terms will become unsustainable. This will necessitate interest rate cuts and a potential “reopening” of the markets in the latter half of next year.

- Quality of Reserves: Akman raised concerns about the reported increase in the TCMB’s foreign currency reserves. He noted that a large portion—reportedly $47 billion of a $60 billion increase—is attributable to gold valuation gains. This suggests the actual inflow of hard currency and the health of the balance of payments may be less robust than official figures indicate.

- Citizen Outlook: Dr. Akman concluded on a somber note, stating that the general economic condition of the average Turkish citizen is unlikely to see significant improvement until at least the final quarter of 2026. He emphasized that without swift governmental action on issues like credit card debt and taxes, Turkey faces serious economic difficulties.

Dr. Akman concluded that while Turkey is rich in human capital, fostering public trust in its monetary authority is the most essential step required to overcome its economic challenges.