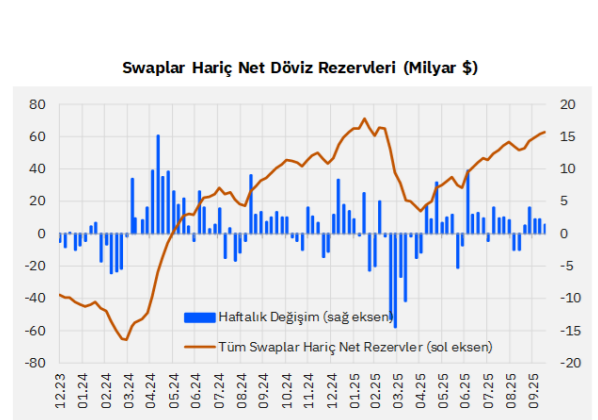

Strong Improvement in Net Reserves; FX Deposits Rise

tcmb rezerv7kasim

tcmb rezerv7kasim

In the week of October 31, a USD 0.6 billion increase in net reserves excluding swaps (a USD 2 billion increase adjusted for gold prices), approximately USD 487 million purchases of

government domestic debt securities (GDDS) by non-residents, and an USD 0.8 billion increase in FX deposits stood out. Additionally, according to the CBRT’s Analytical Balance Sheet, as

of November 5, we estimate an increase of USD 1.2 billion in net reserves excluding swaps (a USD 2.3 billion increase adjusted for gold prices). The weekly developments can be

summarized as follows:

Deposit Composition Shifts; FX-Protected Deposits Continue to Unwind

➢ Parity-adjusted FX deposits, increased by a total of USD 800 million, driven by USD 718 million purchases by individuals and USD 82 million purchases by corporates. Since the beginning of

the year, FX deposits have increased by a total of USD 19.6 billion.

➢ FX-protected deposit (KKM) balances decreased by TRY 34 billion (USD 0.9 billion) during the week, falling to TRY 205 billion. The cumulative unwinding from the peak reached in August

2023 has now exceeded TRY 3.2 trillion (USD 132 billion).

➢ The share of FX deposits + KKM in total deposits stood at 39.9%, compared with a peak of 68.4% in August 2023.

➢ TRY deposits increased by TRY 39 billion during the week, reaching approximately TRY 15.4 trillion.

Loan Momentum: FX Loans Decline, Consumer Loans Accelerate

➢ FX loans decreased by USD 800 million on a weekly basis. Since the end of March 2024, they have increased by 44%, reaching USD 194.2 billion.

➢ Looking at the annualized 13-week average loan growth, commercial loans slowed from 21.4% to 20.4%, while consumer loans accelerated from 45.4% to 48.8%.

Non-Residents Return to GDDS and Equities; Small Eurobond Inflows

➢ In the week ending October 31, non-residents purchased approximately USD 487 million in GDDS, raising the stock to around USD 15.7 billion. Between mid-March and the end of April, GDDS

saw a total outflow of USD 9.3 billion, while from early May onwards, there has been a cumulative inflow of about USD 6.9 billion. In equities, following total net sales of USD 490 million over

the previous four weeks, non-residents made USD 243 million in net purchases, bringing the stock to around USD 32.3 billion. On the Eurobond side, following total outflows of USD 821

million over the previous five weeks, there was a USD 64 million net inflow, raising the stock to approximately USD 82 billion.

Reserves Mixed: Net Reserves Higher, Gold Valuation Pulls Gross Down

➢ Gross international reserves decreased from USD 185.5 billion to USD 183.6 billion, a decline of USD 1.9 billion. Net reserves increased from USD 67.8 billion to USD 69.3 billion, a rise of

USD 1.5 billion, while net reserves excluding swaps rose by about USD 0.6 billion to USD 52.7 billion. The lowest level of net reserves ex-swaps was USD -65.5 billion at end-March 2024,

while the peak was USD 71 billion on February 14, 2025. Between October 17 and October 31, gross reserves declined by USD 14.8 billion, net reserves by USD 10.3 billion, and net reserves

ex-swaps by USD 10.5 billion—of which USD 8.4 billion was attributable to negative valuation effects from falling gold prices.

Early November: Net Reserves Continue to Rise Despite Gold Effect

➢ Based on the CBRT’s Analytical Balance Sheet, as of November 5 (covering the first three business days of the week), we estimate that gross reserves increased by USD 0.6 billion, net

reserves by USD 0.9 billion, and net reserves excluding swaps by approximately USD 1.2 billion. However, during the same period, the gold-price effect was negative by roughly USD 1.1 billion.

Accordingly, excluding the gold-price impact, net reserves ex-swaps increased by about USD 2.3 billion.

Money Market Funds Shrink; Dollarization Trend Continues to Ease

➢ The size of the Money Market Fund (MMF) decreased by around TRY 41 billion in the week of October 31, falling to approximately TRY 1.29 trillion. Under the Free Umbrella Fund, MMF assets

increased by about TRY 32 billion, reaching TRY 1.13 trillion. The total active size of FX-denominated mutual funds declined by roughly USD 200 million to USD 74.7 billion. This level stood

at USD 25 billion at the beginning of 2024 and USD 50 billion at the beginning of 2025. Including investment funds, the dollarization ratio decreased from 42.9% to 42.6% during the week of

October 31. This ratio had reached as high as 70% in mid-2023.

Source: Gedik Invest