Turkey’s SAMEKS Index Signals Continued Expansion as Services Outpace Industry

sameks ekim2025

sameks ekim2025

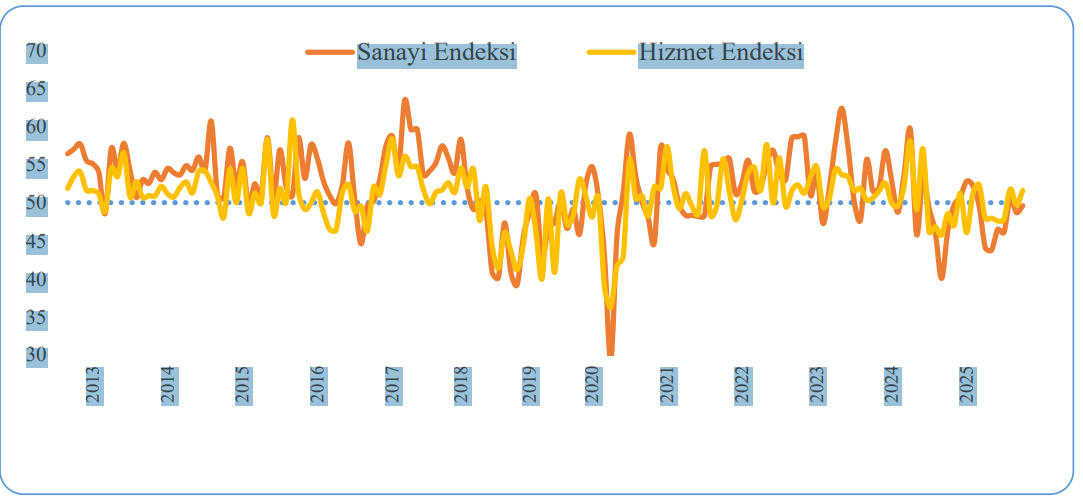

Composite index holds above 50 in October; services drive growth while industrial recovery remains fragile

Turkey’s composite SAMEKS index held above the growth threshold in October, signaling that overall economic activity continues to expand, albeit at a slower and uneven pace across sectors.

According to data released for October 2025, the seasonally and calendar-adjusted SAMEKS Composite Index fell 0.1 points month-on-month to 51.3, remaining in expansion territory for the tenth consecutive month.

The data show that momentum in the service sector is now largely compensating for weakness in industrial output, highlighting the shifting balance in Turkey’s post-tightening growth dynamics.

Industry remains in contraction zone

The Industrial SAMEKS Index fell 0.9 points to 49.6, staying below the 50 threshold that separates expansion from contraction.

While headline figures indicate a slowdown, several sub-indices point to early signs of stabilization:

-

Production rose 3.4 points to 48.5, suggesting that the pace of industrial contraction has eased and that cautious recovery is underway.

-

New orders dropped 1 point to 49.0, reflecting mild demand weakness but relative stability in order flows.

-

Input purchases remained unchanged at 48.5, indicating that firms continue to operate cautiously and are focused on maintaining existing capacity.

-

Inventories surged 5.6 points to 56.1, a sign that manufacturers are preparing for potential demand rebounds in the months ahead.

-

Supplier delivery times fell 5.8 points to 40.7, signaling slower logistics performance and minor supply bottlenecks.

-

Employment plunged 9.3 points to 43.0, underlining reduced labor demand and a shift toward efficiency-driven production planning.

Analysts noted that despite the sector’s contraction, the rise in inventories and production could signal a turning point for manufacturing output later in the fourth quarter.

Services sector regains momentum

The Service SAMEKS Index rose 2 points to 51.6, marking a continued recovery and confirming the sector as the primary driver of Turkey’s growth in late 2025.

Within the sub-indices:

-

Business activity fell 7 points to 49.0, pointing to slower turnover amid weakening domestic demand.

-

Input purchases jumped 11.9 points to 59.1, suggesting renewed optimism and improved supply conditions among service providers.

-

Stocks declined slightly by 1.7 points to 47.7, reflecting cautious inventory management amid volatile demand.

-

Supplier delivery times rose 2.2 points to 51.7, signaling revived logistics and demand-side recovery.

-

Employment surged 13.7 points to 51.4, the strongest reading in months, showing renewed hiring momentum in the service sector.

Economists said the service industry’s resilience is helping offset the drag from manufacturing, keeping Turkey’s composite growth outlook in positive territory.

Expansion sustained, but imbalances deepen

The October reading of 51.3 confirms that the overall economy remains in an expansionary phase, even as the pace of growth moderates.

“The composite index suggests that Turkey’s economic activity continues to expand, led by services and supported by stable domestic demand,” analysts said, adding that manufacturing remains constrained by high costs, labor shortages, and weak external demand.

While the services sector is benefiting from hiring and stronger expectations, industry’s fragile recovery underscores the uneven nature of Turkey’s current growth cycle. Economists see the pattern as evidence that the economy is entering a “moderate but unbalanced expansion” heading into the final quarter of 2025.

Outlook: cautious optimism amid uneven recovery

With SAMEKS holding above the critical 50 mark, Turkey’s short-term outlook remains one of gradual normalization rather than outright acceleration.

Service activity, particularly in employment and procurement, continues to bolster the composite index, while industrial output is weighed down by sluggish external orders and cautious investment.

Economists expect a mild rebound in industrial activity in the coming months if inventory rebuilding and domestic demand persist. However, they caution that policy tightening, weak export markets, and supply-side bottlenecks could limit the pace of recovery through early 2026.