Turkey Redefines Energy Strategy: From Russian Pipelines to American LNG

rte-putin-xi

rte-putin-xi

Turkey is entering a new phase in its energy diplomacy as several of its long-term natural gas contracts with Russia near expiration — marking a strategic shift toward diversified and more flexible energy partnerships.

Russia Contracts Near Expiry

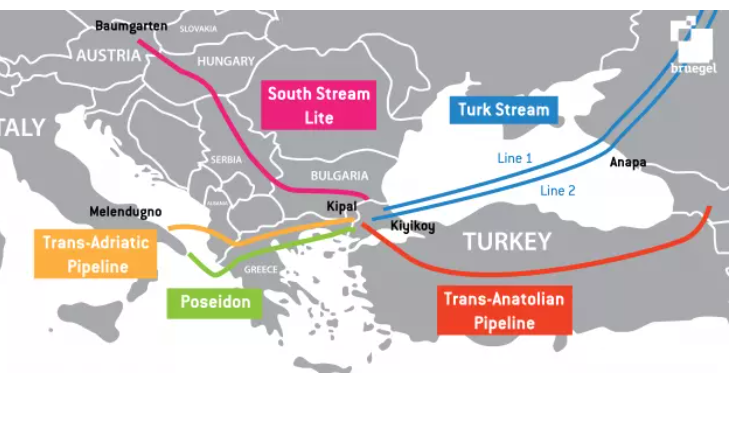

The country’s two main supply routes — Blue Stream (16 bcm/year) and TurkStream (5.75 bcm/year) — currently meet around 40% of Turkey’s natural gas demand.

However, parts of these agreements are set to expire between late 2025 and early 2026, putting Ankara back at the negotiation table — this time with more leverage.

Turning Toward U.S. and Global LNG

In a landmark move in September 2025, state energy company BOTAŞ signed a 20-year, $43 billion LNG supply deal with Switzerland-based Mercuria Energy Trading, covering 70 bcm of U.S.-sourced gas for the 2026–2045 period.

Additionally, Turkey reached a preliminary Heads of Agreement with Australia’s Woodside Energy, securing 5.8 bcm of LNG between 2030 and 2038.

Energy expert Mehmet Öğütçü, Chairman of the London Energy Club, describes this as a “strategic insurance policy — not just a commercial transaction.”

“Turkey is signaling to Washington that it’s diversifying, and to Moscow that it’s no longer a single-supplier client,” Öğütçü said.

Not a Break from Moscow — A Strategic Balancing Act

Despite Western commentary framing this as a “pivot away” from Russia, Ankara’s approach remains pragmatic rather than ideological.

Russia remains Turkey’s largest energy partner — as Akkuyu Nuclear Plant’s investor, and a key trade and tourism partner.

Yet, after Russia’s invasion of Ukraine and its weaponization of gas exports, Turkey began redefining “energy independence” — not as isolation from suppliers, but as freedom to choose among them.

Is American LNG Really More Expensive?

The long-debated claim that “U.S. LNG costs three times more” no longer holds.

After factoring in Henry Hub prices ($3.5–4.5/mmbtu) plus liquefaction, shipping, and regasification, U.S. LNG costs roughly $6.8–8.8/mmbtu — about $240–310 per 1,000 cubic meters.

Russian pipeline gas historically ranged from $300–400 per 1,000 cubic meters.

The real advantage of LNG lies not in price — but in flexibility: it can be stored, rerouted, or re-exported.

Turkey’s Tuz Gölü and Silivri underground facilities currently hold about 11 bcm, roughly 15% of annual demand, supported by three full-capacity FSRUs.

Local Gas and Renewables Rising

The Sakarya gas field in the Black Sea produces 9–9.5 million cubic meters/day, meeting about 6% of domestic demand.

Targets: 20 mcm/day by 2026 and 40 mcm/day by 2028.

However, experts note progress is slowed by technical and financial hurdles.

Meanwhile, renewables now account for over 60% of electricity generation, positioning Turkey among G20 leaders in clean energy.

Ankara is also exploring Small Modular Reactor (SMR) partnerships with the U.S. and the U.K., complementing Russia’s Akkuyu project.

A New Kind of Energy Sovereignty

Turkey’s energy strategy now balances three key pillars:

-

Supply Security – Diversify sources to reduce crisis vulnerability.

-

Price Competitiveness – Loosen “take-or-pay” obligations in long-term deals.

-

Political Autonomy – Maintain independence from both Moscow and Washington.

“Energy is no longer just fuel — it’s geopolitical capital,” Öğütçü emphasized.

“Used wisely, it can make Turkey not just an energy consumer, but a regional energy hub.”