Turkey’s Reserves Rise in Headline Terms but Gold Effect Masks Underlying Decline

tcmb rezerv

tcmb rezerv

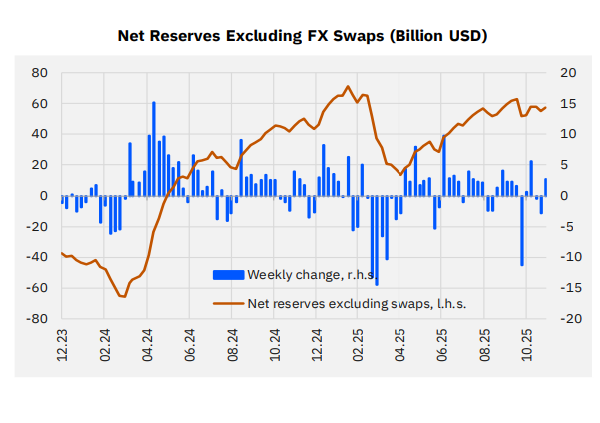

While the Central Bank of Turkey’s (CBRT) gross and net reserves appeared to increase in the week ending October 17, much of the gain was driven by valuation effects from surging gold prices rather than genuine inflows. Excluding the gold effect, swap-adjusted net reserves actually fell by $7.4 billion. The trend highlights growing dollarization, persistent outflows from FX-protected deposits, and ongoing volatility in capital flows — suggesting that Turkey’s external position remains fragile despite strong top-line figures.

Headline Gains Conceal a Drop in Core Reserves

In the week ending October 17, the CBRT’s swap-adjusted net reserves rose by $1.4 billion to $63.2 billion, while gross reserves increased by $8.7 billion to $198.4 billion.

However, when adjusted for the valuation effect of gold prices — which added roughly $8.8 billion — the underlying data shows a $7.4 billion decline in reserves.

According to the CBRT’s Analytical Balance Sheet, during the first three days of the following week (ending October 22), swap-adjusted net reserves fell again by about $9.2 billion, or $2.3 billion excluding gold effects.

Foreign Deposits and Dollarization on the Rise

Foreign exchange deposits (DTH) rose by $2.3 billion in the same week — split evenly between households (+$1.2 billion) and corporates (+$1.1 billion).

Since the start of 2024, total FX deposits have climbed by $20.1 billion, signaling a renewed preference for dollar assets despite high local yields.

When investment funds are included, the overall dollarization ratio rose to 43.5% from 43.3% a week earlier — still well below the mid-2023 peak of 70%, but showing a mild upward drift.

Ongoing Unwinding in FX-Protected Deposits (KKM)

The FX-protected deposit scheme (KKM) continued to shrink, falling ₺34 billion (≈$0.9 billion) in the week to ₺205 billion.

Since peaking in August 2023, cumulative withdrawals have reached ₺3.2 trillion (≈$132 billion).

Combined, FX deposits plus KKM now account for 40.9% of total deposits, down sharply from 68.4% at their peak — a structural shift that reflects both monetary tightening and reduced lira conversion incentives.

Lira Deposits and Credit Expansion

TL deposits rose by ₺441 billion during the week, reaching approximately ₺15.3 trillion.

Meanwhile, foreign-currency loans increased by $1.5 billion, bringing the total to $195.6 billion, up 45% since March 2024.

The 13-week annualized loan growth shows divergent trends:

-

Commercial loans slowed from 21.6% to 20.2%,

-

Consumer loans accelerated from 42.1% to 45.2%.

This pattern suggests that while corporate borrowing is cooling under tighter conditions, consumer credit remains resilient, complicating the CBRT’s disinflation efforts.

Foreign Investor Flows: Modest DİBS Inflows, Equity Outflows

Foreign investors recorded net purchases of $151 million in government bonds (DİBS), lifting total holdings to $15.4 billion.

Since May, foreign funds have added over $6.8 billion to DİBS, partially offsetting $9.3 billion in outflows between mid-March and late April.

In contrast, equities saw net sales of $178 million, reducing total foreign holdings to $30.7 billion.

On the eurobond side, foreigners sold $441 million, bringing the stock to $81.5 billion.

Investment Funds and Market Positioning

The Money Market Fund (MMF) segment expanded by ₺8 billion to ₺1.29 trillion, while Free Umbrella Funds under the same category rose ₺22 billion to ₺1.1 trillion.

All FX-denominated funds grew by $843 million during the week, reaching a record $74 billion — up sharply from $25 billion at the start of 2024 and $50 billion at the beginning of 2025.

This continued rise in FX fund assets underscores a renewed investor appetite for hard-currency instruments, reflecting uncertainty over the lira’s medium-term stability.

Key Takeaway: Cosmetic Stability, Structural Fragility

The latest CBRT data illustrate the duality of Turkey’s external position: while headline reserves look healthy, valuation effects from gold and lira volatility obscure real declines in liquid reserves.

At the same time, dollarization pressures, rising consumer lending, and inconsistent foreign investor flows suggest that confidence remains fragile.

Unless the CBRT’s reserve build-up becomes driven by sustained inflows — rather than price effects — analysts warn that Turkey’s external buffers could erode quickly under renewed market stress.

Source: Gedik Invest