Türkiye to Stay the Course on Disinflation Despite Temporary Setbacks

IMF

IMF

Türkiye will maintain its commitment to lowering inflation, despite a recent slowdown in disinflation momentum, European Bank for Reconstruction and Development (EBRD) President Odile Renaud-Basso told Reuters after returning from the IMF–World Bank Annual Meetings in Washington, D.C.

Renaud-Basso said she held detailed discussions with Finance Minister Mehmet Şimşek about Türkiye’s inflation dynamics, noting that the government attributes recent setbacks to temporary, non-structural factors such as drought-related food price pressures and other short-term shocks.

“He explained there is a bit of temporary factors, like the impact of drought and specific factors that could have an impact,” she said. “But I think the objective to decrease inflation will remain on track — these objectives are not going to change. They are going to keep the policy course.”

Inflation Spikes Again After a Year of Decline

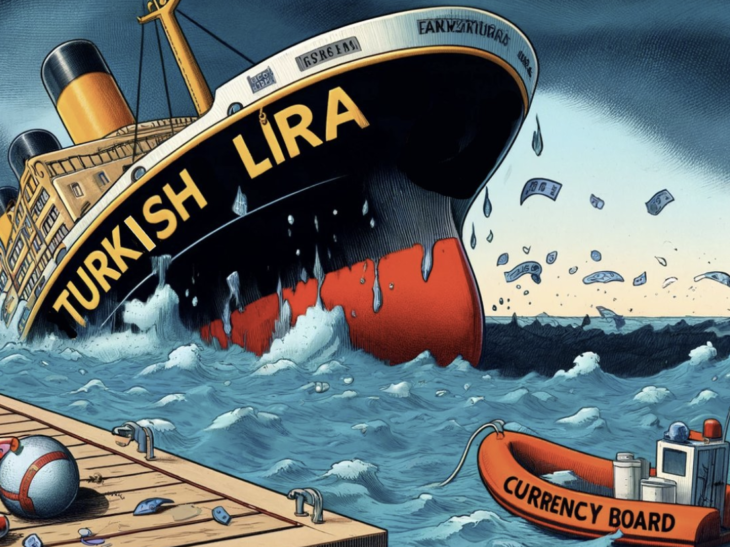

Türkiye’s consumer price index (CPI) rose 33.3% year-on-year in September, exceeding expectations and marking the first annual increase since inflation peaked at 75.4% in May 2024. August’s data also came in higher than expected, signaling renewed inflationary pressure despite the government’s disinflation drive launched earlier this year.

Economists attribute the uptick to seasonal drought effects, volatile food prices, and exchange rate pass-through, though they broadly expect inflation to resume a downward trajectory in 2026 as monetary conditions tighten further.

Central Bank Signals Caution on Rate Cuts

The Central Bank of the Republic of Türkiye (CBRT) is widely expected to trim its key policy rate by 100 basis points this month, according to a Reuters poll of economists. However, sources say the bank may slow the pace of cuts in response to rising inflation risks.

CBRT Governor Fatih Karahan and his two deputies recently met with global investors in Washington, where they reportedly expressed concern over persistent price pressures, indicating that policymakers are prepared to pause or moderate rate reductions if inflation fails to decelerate as planned.

EBRD’s Confidence in Türkiye’s Policy Direction

Renaud-Basso reaffirmed the EBRD’s confidence in Türkiye’s macroeconomic framework, praising the government’s focus on fiscal discipline and monetary normalization under Minister Şimşek.

“The commitment to the disinflation process remains intact,” she said, describing Türkiye’s current policy mix as “a necessary balancing act between price stability, growth, and social resilience.”

The EBRD has long been one of Türkiye’s largest institutional investors, channeling funds toward green energy, infrastructure, and private-sector development. The bank’s support continues to hinge on macroeconomic credibility and policy consistency.

Analysts Expect Gradual Progress

While the near-term inflation outlook remains uncertain, analysts see 2025–2026 as a stabilization period, provided that the government sustains a tight fiscal stance and avoids premature easing.

Renaud-Basso’s comments echo this sentiment — that Türkiye’s disinflation strategy, though temporarily challenged, is structurally intact and likely to stay its course into 2026.