Crackdown or Capital Grab? Turkey’s State Fund Now Controls 1,000 Companies

haberturk

haberturk

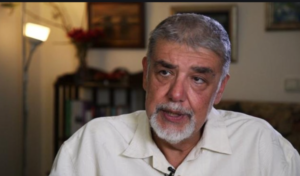

Analyst Atilla Yeşilada warns: “This looks less like a clean-hands campaign, and more like a systemic reshuffling of private capital.”

Turkey’s anti-corruption drive has taken a dramatic turn, as the Savings Deposit Insurance Fund (TMSF) — a state-controlled body — now manages more than 1,000 companies, following a wave of raids and asset seizures that have shaken the country’s business elite.

Analysts warn that what began as a campaign to clean up corruption may be evolving into a politically driven consolidation of economic power, reinforcing President Recep Tayyip Erdoğan’s control over the private sector ahead of the 2028 elections.

From deposit insurance to economic powerhouse

Originally established in 1983 to protect bank deposits, the TMSF’s powers expanded significantly after the failed 2016 coup attempt, when it began acting as the state’s trustee for confiscated businesses.

According to official figures, the TMSF currently oversees 1,056 companies, up from 675 a year ago — a staggering increase that cuts across virtually every sector, including media, energy, finance, manufacturing, education, and even Kasımpaşa Football Club, Erdoğan’s boyhood team.

Under new regulations enacted in February, courts can now place companies under TMSF control based merely on “strong suspicion” of financial crimes such as money laundering.

Big names caught in the crossfire

In early September, prosecutors ordered the seizure of 121 companies belonging to Can Holding, a major conglomerate involved in media and education. The company’s owner, Kemal Can, and nine others were detained on charges of smuggling, tax evasion, and money laundering.

Among the seized assets was Habertürk Media, one of Turkey’s few remaining semi-independent broadcasters, including Bloomberg HT TV, which operates under a licensing deal with Bloomberg.

Just weeks later, prosecutors expanded the probe to include parts of the Ciner Group, a diversified industrial and media conglomerate, alleging that its sale of Habertürk Media to Can Holding last year may have been linked to fraudulent activity — despite regulators having cleared the deal months earlier.

And most recently, 21 executives linked to the Istanbul Gold Refinery (IGR) — one of Turkey’s top five industrial companies — were detained in another high-profile operation. The London Bullion Market Association confirmed it has launched an “incident review process” regarding the refinery’s conduct.

Mounting fear in business circles

The wave of raids and detentions has rattled Turkey’s business community, raising questions about property rights, judicial independence, and selective enforcement of the law.

Dr. Berk Esen of Sabancı University notes that the ruling Justice and Development Party (AKP) has “long used the TMSF as a dual tool — to regulate the economy and to channel resources toward companies close to itself, while sidelining perceived rivals.”

He added: “The government seems intent on reshaping who controls the economy, essentially reconfiguring Turkey’s corporate landscape.”

Atilla Yeşilada: “A full-blown attack on the private sector”

In remarks to ParaAnaliz, economist Atilla Yeşilada, senior partner at GlobalSource Partners, said the recent crackdowns could have far deeper implications than the government admits:

“The unspoken fear in the business community is that these are not genuine ‘clean-hands’ operations but a full-blown attack on the private sector. Erdoğan’s goal appears to be to reroute capital — either to the Treasury through TMSF or into the hands of loyal allies. I am genuinely worried this process could continue for years.”

According to Yeşilada, the crackdown risks eroding what little investor confidence remains in the Turkish economy. “The message is clear — no one is untouchable,” he said.

Political message or economic necessity?

Analysts are divided on the government’s motives. Some see the raids as part of Erdoğan’s effort to portray himself as tough on corruption at a time of mounting economic hardship and political tension. Others believe it is a desperate attempt to rebuild a patronage system and consolidate fiscal resources before the next election cycle.

Meanwhile, the value of assets under TMSF management reached TL 328 billion (approx. $10 billion) earlier this year — a scale that gives the fund unprecedented influence over key sectors of the Turkish economy.

“There are no untouchables”

Wolfango Piccoli of consultancy Teneo summarized the broader message succinctly:

“If I had to speculate, this is Erdoğan sending a message — there are no untouchables in Turkey’s business landscape.”

Whether seen as an anti-corruption campaign or a strategic capital grab, the result is the same: the boundaries between the state and the private sector are blurring faster than ever.