Deutsche Bank: Investors Strongly Endorse Türkiye’s Macro Rebalancing Progress

deustche

deustche

Following high-level meetings in Ankara and Istanbul, Deutsche Bank says foreign investors are increasingly confident in Türkiye’s macro-financial stabilization efforts, but inflation inertia and policy coordination remain key risks.

Strong Investor Approval for Türkiye’s Policy Direction

Deutsche Bank’s Türkiye economist Yiğit Onay has released a new investor note following meetings with policymakers and stakeholders in Ankara and Istanbul. The findings reveal strong foreign investor confidence in Türkiye’s macroeconomic trajectory.

“Our visits confirmed that investors strongly endorse the progress in Türkiye’s macro-financial rebalancing,” the note states. “Positive sentiment, highlighted by renewed interest in the Turkish lira and an improving risk premium, reflects the effectiveness of robust macroeconomic policymaking in shielding the economy from internal and external shocks, while reducing financial vulnerabilities.”

Inflation Still a Major Hurdle

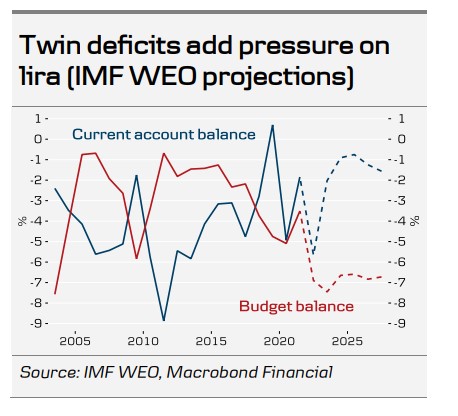

Despite this optimism, the report warns that inflation remains the primary challenge for Türkiye’s economic outlook. Persistent domestic demand and entrenched inflation expectations may prevent the government from meeting the disinflation targets outlined in the Medium-Term Program (MTP).

“While authorities maintain cautious optimism on the inflation outlook,” Onay writes, “they appear fully committed to maintaining their policy stance until there is clear evidence of sustainable disinflation.”

The report emphasizes the crucial role of fiscal policy, prudent income policies, progress on structural reforms, and clear communication of the economic program—particularly with domestic market participants—in supporting inflation control.

Key Takeaways from the Field

Deutsche Bank highlighted several major conclusions from their field visits:

-

A soft landing scenario remains plausible, though not guaranteed

-

Inflation persistence is still a downside risk to the overall outlook

-

The Turkish lira is not currently facing any immediate pressure on the exchange rate front

-

Monetary policy credibility remains the core anchor for inflation expectations

IMPORTANT DISCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/