August budget: Considerable improvement in the primary balance continues

budget-august

budget-august

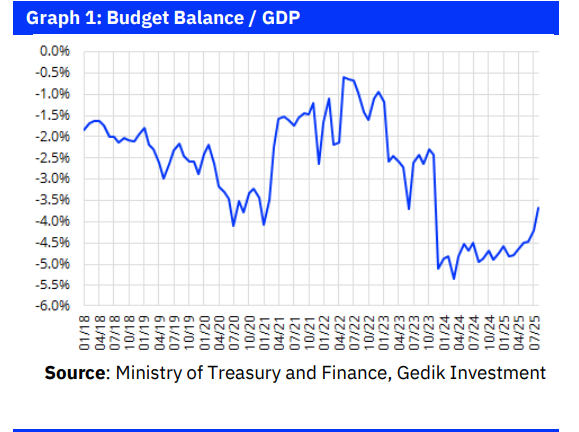

The central government budget posted a TL96.7bn surplus in August, while the 12-month rolling deficit narrowed to TL2.04trl. The primary balance registered a TL276.4bn surplus. In the same month last year, the budget and primary balances had recorded deficits of TL129.6bn and TL32.5bn, respectively.

On a 12-month cumulative basis, the budget deficit fell from TL2.27trl to TL2.04trl, while the primary deficit declined from TL417bn to TL108bn. These figures had stood at TL2.11trl and TL836bn, respectively, at end-2024. Adjusting last year’s figures for inflation, the August 2024 balances translate into a TL172bn budget deficit and a TL43bn primary surplus in today’s prices.

Base effects from last year’s revenue shifts also play a role in the YoY improvement.

The dramatic improvement in headline budget metrics versus last August partly reflects timing effects. Last year, a large portion of temporary corporate tax payments and some personal income tax receipts were deferred to September, which now artificially inflates the YoY comparison. Hence, a combined assessment of the August–September figures next month will provide a clearer picture. On the expenditure side, non-interest spending rose 40% YoY in nominal terms and 5% in real terms—higher than in recent months, though still pointing to a contained pace of spending.

Primary balance shows marked improvement in Jan–Aug.

In January–August, non-interest expenditures rose 37% YoY in nominal terms (flat in real terms), while tax revenues grew 56% (14% in real terms). Stronger collections were supported by higher withholding taxes on deposit and mutual fund income, with personal income tax revenues up 93% YoY. We estimate that the July 9 hike in withholding tax (from 15.0% to 17.5%) could generate around TL80bn in additional revenues in H2. Thanks to buoyant tax receipts and controlled noninterest spending, the primary balance swung from a TL210bn deficit in Jan–Aug 2024 to a TL518bn surplus in the same period of 2025. By contrast, the budget deficit narrowed only slightly, from TL974bn to TL908bn.

Surging interest payments continue to weigh on the headline deficit.

The limited improvement in the budget deficit once again reflects the drag from rising interest expenditures. Interest spending rose from TL764bn in the first eight months of 2024 to TL1.43trl in the same period of 2025, an 87% increase.

Notably, the Medium-Term Program (MTP) published last week revised interest expenditure projections up to TL2.05trl for 2025 from TL1.95trl and to TL2.74trl for 2026 from TL2.28trl. Despite strong growth in tax revenues in recent years, the faster rise in interest payments has pushed the interest-to-tax revenue ratio higher, contributing materially to the deterioration in the budget balance.

Full-year deficit likely at around 3.6–3.7% of GDP.

We had previously noted that the budget deficit would likely exceed the government’s initial projection of TL1.9trl (3.1% of GDP), instead coming in at around TL2.1–2.2trl (3.6–3.7% of GDP). The latest MTP also revised the government’s projection to TL2.2trl.

Despite contained non-interest spending, this upward revision reflects revenue underperformance (even with additional withholding tax income) and higher interest costs. The fact that the government projects 28% growth in tax revenues for 2026—well above its 19.7% deflator assumption—raises the prospect of additional tax measures, or potential changes to inflation accounting, or both.

Analysis: Chief Economist Serkan Gonencler, Gedik Yatirim