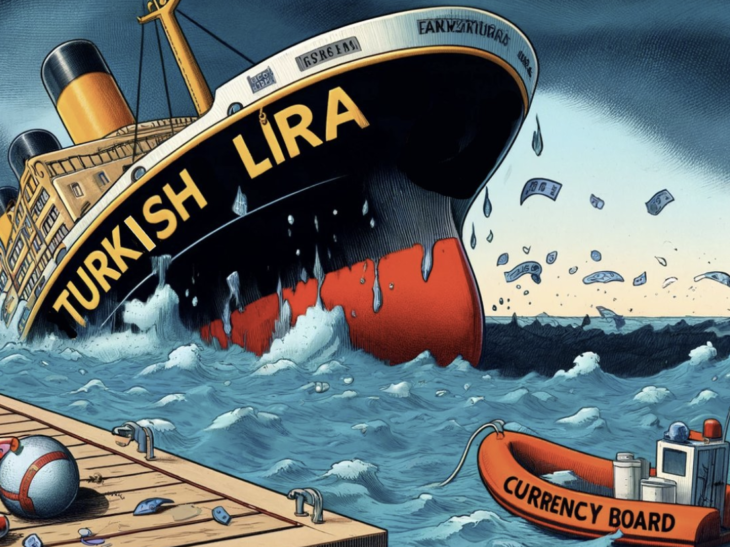

Commerzbank: “Further CBRT Rate Cuts Could Deepen Turkish Lira Losses”

commerzbank

commerzbank

Summary:

Commerzbank economist Tatha Ghose expects the Central Bank of Turkey (CBRT) to cut its policy rate by 200 basis points to 41% at today’s meeting, despite persistent inflation and ongoing FX market interventions. Ghose warns that additional rate cuts in the coming months could further weaken the Turkish lira, which has already slipped to ₺41.29 against the U.S. dollar ahead of the decision.

Markets Brace for CBRT’s Rate Decision

The Central Bank of the Republic of Turkey (CBRT) will announce its interest rate decision today at 14:00 local time.

-

Consensus forecast: A 200bps cut to 41%

-

Key driver: Political pressure from President Recep Tayyip Erdoğan

-

Market impact: Heightened FX volatility and weaker TL sentiment

Commerzbank notes that the decision is expected despite insufficient signs of slowing inflation and continued daily FX interventions to stabilize the lira.

Tatha Ghose: “Lira Faces Extended Weakness”

According to Tatha Ghose, CBRT’s upcoming cut could open the door to additional rate reductions over the next several months:

-

A faster-than-expected easing cycle may pressure the lira further.

-

Daily market interventions to manage volatility will likely continue.

-

However, this strategy risks placing additional strain on FX reserves.

Ghose highlights that unless inflation decelerates convincingly, pressure on the lira will persist, making it harder for policymakers to anchor market expectations.

USD/TRY Rises Ahead of Decision

Ahead of today’s announcement, the Turkish lira weakened further against the U.S. dollar:

-

USD/TRY climbed 0.1% to ₺41.2908 as of 10:30 local time.

-

Traders are positioning cautiously, anticipating potential volatility spikes after the CBRT decision.

Outlook: High Uncertainty for Turkish Assets

Analysts remain concerned about the outlook for Turkish assets amid policy uncertainty:

-

Inflation remains stubbornly elevated.

-

FX reserves, while improving, remain vulnerable to heavy interventions.

-

The lira could test the ₺41.50–₺42.00 range if rate cuts accelerate.

Markets will closely watch CBRT’s forward guidance and policy communication to gauge the depth and pace of future easing cycles.

Source: Commerzbank, ForInvest Newsroom