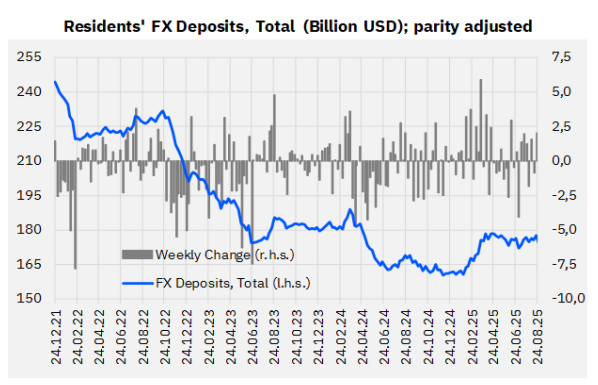

CBRT Weekly Data: Net Reserves Rise by $2.6 Billion, Dollarization Inches Higher

mevduat

mevduat

In the week of August 22, the Central Bank of the Republic of Turkey (CBRT) reported a $2.6 billion increase in net reserves excluding swaps, a $97 million purchase of government domestic debt securities (GDDS) by non-residents, and a $2 billion rise in FX deposits.

Additionally, based on the CBRT’s Analytical Balance Sheet, as of August 26, net reserves excluding swaps are estimated to have increased by another $1.3 billion.

The weekly developments are summarized as follows:

FX Deposits and FX-Protected Deposits (KKM)

-

Parity-adjusted FX deposits rose by a total of $2 billion:

-

Households recorded $77 million in FX sales,

-

Corporates purchased $2.1 billion worth of FX.

-

Since the start of the year, total FX deposits have increased by $16 billion.

-

-

FX-protected deposits (KKM) fell TRY 13.4 billion ($0.38 billion) on the week, declining to TRY 427.1 billion.

-

The cumulative unwinding since the August 2023 peak has now reached TRY 3 trillion ($126.3 billion).

-

-

The share of FX deposits + KKM in total deposits rose from 39.6% to 40%.

-

At its August 2023 peak, this ratio was 68.4%.

-

-

TRY deposits decreased by TRY 136 billion over the week, falling to approximately TRY 14.8 trillion.

Loan Developments

-

FX loans declined $0.8 billion on a weekly basis.

-

However, since end-March 2024, FX loans are up 43.6%, rising $57.8 billion to reach $192.5 billion.

-

-

Annualized 13-week average loan growth:

-

Commercial loans slowed from 24.4% to 22.2%.

-

Consumer loans eased slightly from 37.9% to 37.3%.

-

Foreign Investor Activity

-

In the week of August 22, non-residents recorded $97 million in net purchases of government domestic debt securities (GDDS).

-

GDDS holdings rose to $14.7 billion.

-

-

Between mid-March and end-April, GDDS experienced $9.3 billion in outflows,

-

Since early May, there has been a cumulative inflow of $4.4 billion.

-

-

In the equity market, non-residents bought $90 million net:

-

Equity holdings increased to $34.9 billion.

-

Since the week of April 18 (excluding the week of June 20), equities have seen $2.9 billion of continuous inflows.

-

-

On the Treasury Eurobond front, non-residents recorded $232 million in net sales during the week,

-

Reducing total Eurobond holdings to $77.2 billion.

-

Reserve Developments

-

Gross reserves fell slightly to $176.3 billion from $176.5 billion, a decline of $0.2 billion during the week of August 22.

-

Net reserves rose by $1.9 billion, reaching $71.9 billion from $70 billion.

-

Net reserves excluding swaps climbed $2.6 billion to $54.8 billion.

-

Net reserves excluding swaps hit a low of –$65.5 billion at end-March 2024.

-

They reached a peak of $71 billion on February 14, 2025.

-

-

According to the CBRT Analytical Balance Sheet, as of August 26 (covering the first two business days of the week):

-

Gross reserves increased by $1.8 billion,

-

Net reserves rose by $1.1 billion,

-

Net reserves excluding swaps grew by $1.3 billion.

-

Money Market Funds and Investment Funds

-

The size of Money Market Funds (MMFs) increased by TRY 100 billion during the week of August 22, reaching approximately TRY 1.25 trillion.

-

Within the Free Umbrella Fund, MMFs fell TRY 52 billion over the week, settling slightly above TRY 1 trillion.

-

The total active size of FX-denominated mutual funds rose $90 million weekly, reaching $65 billion.

-

At the start of 2024, this figure stood at $25 billion.

-

-

Including investment funds, the dollarization ratio climbed from 41.3% to 41.6% in the week of August 22.

-

At the start of 2024, this ratio was around 59%.

-