ING Sees Further Rate Cuts in Turkey Amid Easing Inflation and Slowing Growth

tr-ekonomi

tr-ekonomi

ING’s latest “Monitoring Turkey” report signals that the Central Bank of the Republic of Turkey (CBRT) is likely to continue its monetary easing cycle in the coming months. Improved inflation expectations, weaker economic momentum, and stronger foreign exchange reserves—boosted by renewed foreign inflows and reduced domestic FX demand—are creating room for additional rate cuts.

Inflation Trend Turns Down Despite Temporary Price Shocks

Inflation indicators in July reflected the impact of government-imposed price hikes and automatic tax adjustments. According to ING, these influences are temporary, and the underlying disinflation trend is expected to persist.

The CBRT’s most recent Inflation Report projects consumer price inflation to decline to 24% in 2025—within a forecast range of 19% to 29%—and further to 12% in 2026. The Bank’s next inflation report, due 14 August, will offer fresh insights into the price outlook and potential policy adjustments.

Despite the encouraging inflation prints, ING remains cautious. The lira’s steady depreciation poses upside risks, and ING forecasts year-end inflation at 29.5%. It expects the CBRT to cut policy rates by 300 basis points at its September Monetary Policy Committee meeting, followed by two more 250bp cuts, bringing the rate down to 35% by the end of 2025.

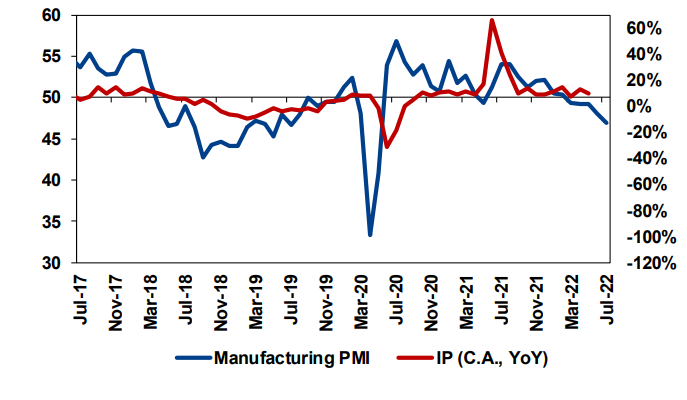

Economic Growth Losing Steam

The Turkish economy is slowing under the weight of tight monetary policy, weak external demand, and gradual fiscal consolidation. ING forecasts real GDP growth to ease to 2.7% in 2025 from 3.2% in 2024, before rebounding to 3.5% in 2026 as lower rates and a recovery in global demand take effect.

Finance Minister Mehmet Şimşek recently acknowledged that the government may miss its 2025 budget deficit target of 3.1% of GDP, citing weaker-than-expected revenue performance. As a result, the government has resorted to measures such as automatic adjustments in lump-sum taxes, a natural gas price hike in July, a higher withholding tax rate, and increases in Special Consumption Taxes (SCT) on automobiles.

ING estimates that the budget deficit could approach 4% of GDP by year-end—significantly higher than the Medium-Term Program’s forecast.

FX Policy: Controlled Depreciation Continues

The Turkish lira maintained a steady and gradual depreciation against the U.S. dollar in July, with no major policy surprises. High carry yields continue to attract investor interest, keeping demand for lira assets robust.

Even the CBRT’s slightly more dovish-than-expected resumption of rate cuts failed to meaningfully alter the USD/TRY trajectory. ING sees little change in FX policy in the coming months and considers the lira its top carry currency pick in the emerging market space.

The central bank has made it clear it will not tolerate additional inflationary pressures from the exchange rate. ING prefers spot over forward positions in lira, citing potential liquidity tightness during volatility. The bank’s forecasts put USD/TRY at 42.23 by end-Q3 and 45.00 by year-end.

Bond Market: Rally Pauses as Yields Tighten

Turkish government bonds (TURKGBs) rallied strongly in late June and early July. Since then, prices have moved sideways, with performance varying along the yield curve. The spread against the OIS curve has narrowed, making bonds less attractive in the short term.

June and July saw a sharp increase in supply after a subdued May, when the Ministry of Finance scaled back issuance due to high yields. ING calculates that the ministry has already covered roughly 63% of its annual issuance target. While a wider fiscal deficit could increase supply risk, the ministry currently appears to be in a comfortable funding position thanks to solid investor demand.

Sovereign Credit: Rating Upgrades Support Stability

Emerging market credit spreads have widened recently amid a rally in U.S. Treasury yields, but Turkey has proven resilient. The spread differential versus BB-rated peers has tightened by around 40 basis points over the past month.

In late July, Moody’s upgraded Turkey’s sovereign rating to Ba3, matching Fitch and S&P and aligning with market pricing that already reflected BB-level risk. ING expects credit spreads to remain stable over the summer, with new sovereign issuance in September likely serving as the next catalyst unless political shocks intervene.

Although Turkey’s spreads now offer less potential for further outperformance relative to peers, ING expects investor demand to remain solid, particularly for shorter-dated sukuk, which continue to offer a pickup over conventional bonds.

Public Finances: Primary Balance Improves in June

June fiscal data showed a notable improvement in the IMF-defined primary balance, excluding one-off revenues. Tax revenues rose 13.9% year-on-year in real terms, driven primarily by income tax receipts, which jumped over 42%. Corporate tax, however, fell 22.3% in real terms.

Value Added Tax (VAT) and Special Consumption Tax (SCT) collections increased by 17.5% and 8.6% in real terms, respectively. Non-interest expenditures grew just 5.9% year-on-year, with healthcare, pensions, and social assistance spending down 6.7%.

Interest expenses, by contrast, more than doubled in real terms. The June primary deficit stood at TRY 104 billion, while the 12-month rolling primary deficit fell to TRY 890 billion, or 1.7% of GDP—still above the Medium-Term Program’s target of TRY 294 billion (0.5% of GDP).

IMPORTANT DISCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/