New Excise Tax Adjustment Expected to Have Minimal Inflation Impact

Auto Sales

Auto Sales

The Turkish Ministry of Treasury and Finance has announced that the latest revision to the Special Consumption Tax (ÖTV) is projected to raise inflation by only 0.0019 percentage points on an annual basis.

In a public statement, the Ministry explained that under the authority granted by Law No. 7555, a new regulation has been introduced for passenger car taxation. The updated system adjusts the ÖTV base and rates based on a combination of factors including engine displacement, electric range, and battery capacity.

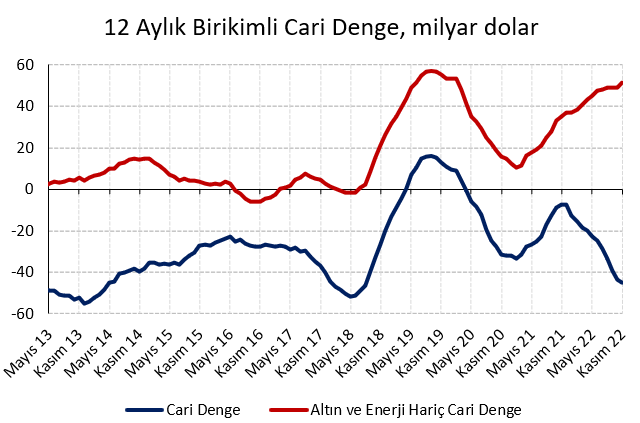

The Ministry emphasized that the main goal of this move is to help reduce Turkey’s current account deficit. It provided the following breakdown:

-

ÖTV rates have been lowered by 5 to 10 percentage points for certain high-volume vehicle groups.

-

Existing rates remain unchanged for some models.

-

For other models, ÖTV rates have been increased by 10 to 20 percentage points.

Because the revision includes both tax reductions and hikes, the Ministry predicts that the net inflationary effect will remain negligible, despite fluctuations in pricing across different car segments.

This restructuring is part of the government’s broader effort to balance fiscal discipline, encourage eco-friendly vehicle adoption, and curb imports that impact the current account deficit.