Tacirler Yatırım 2H25 Strategy: Lira Outlook Stable, Interest Rates Higher for Longer, Equities to Recover

borsa doviz faiz

borsa doviz faiz

In its mid-year strategy update, Tacirler Yatırım forecasts relative stability for the Turkish lira, a revised interest rate path following the March 19 pivot, and moderate recovery potential for Borsa Istanbul in the second half of 2025. Model portfolio adjustments include the removal of Aselsan and Yapı Kredi, replaced by Garanti Bank.

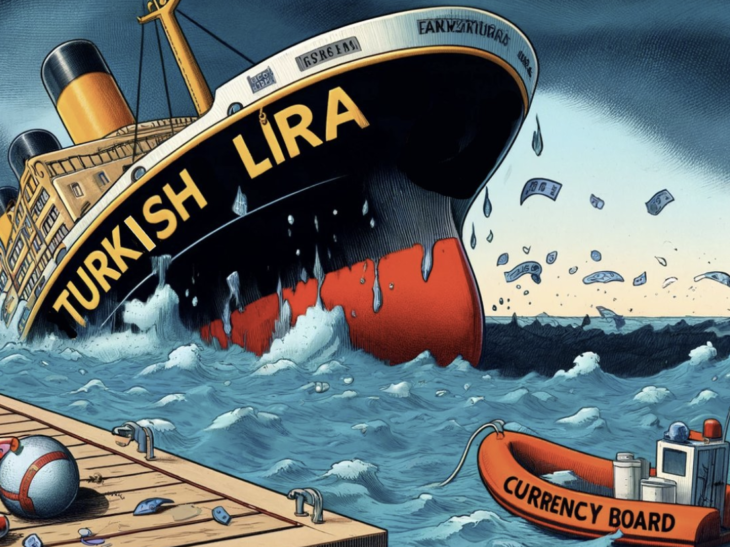

FX Markets: Real Appreciation Expected to Resume

Despite the Central Bank of Turkey’s (CBRT) heavy use of reserves in the four weeks following March 19, tight monetary policy and high real interest rates have kept the Turkish lira relatively stable.

Key insights:

-

Over the past year, the lira gained around 8% in real terms against a half-dollar, half-euro basket.

-

Since March, that trend has plateaued; year-to-date, the lira has lost around 3% in real terms.

Tacirler anticipates a resumption of real appreciation in the lira due to:

-

Weakening FX demand

-

Recovery in reserves

-

Continued real positive yield environment

Year-end basket rate is forecast at 47.5 TL, implying a 9% depreciation in 2H25. However, with CPI expected at 31% for 2025, this suggests a 2% real appreciation over the second half.

Interest Rates: Post-March Path Revised Upward

The year began with successive CBRT rate cuts—three reductions of 250 bps each between December 2024 and March 2025, bringing the policy rate from 50% down to 42.5%.

However, the post-March 19 reversal changed the landscape:

-

Policy tightening resumed

-

The weighted average cost of funding rose to the 46–49% range

This pivot disrupted market rate forecasts, valuation models, funding costs, and broader financial conditions. Although a gradual normalization is still expected in 2H25, Tacirler believes year-end rates will remain above initial projections.

Under optimal macro scenarios, conditions seen before March may only return by mid-2026.

Equities: Second Half Could Bring Renewed Opportunities

The BIST 100 index, which reached 11,000 in mid-March, fell back to the 9,000 level after the policy shift. Year-start targets around 14,000 were revised down to 13,500.

Key market pressures:

-

Higher interest rates affecting corporate cost structures and valuations

-

Political and macro uncertainty weakening growth and trading volume expectations

-

Declines in profit and revenue forecasts

Nevertheless, Tacirler sees upside potential in the second half. A gradual easing of rates, coupled with improved market sentiment, could make Turkish equities more attractive. The firm’s updated 12-month target for BIST 100 is 13,600, signaling 36% upside from current levels.

Model Portfolio: Aselsan and Yapı Kredi Out, Garanti In

Since its inception in June 2023, Tacirler’s Model Portfolio has delivered 168% nominal return, outperforming the BIST 100’s 86% gain by 44 percentage points. However, performance has recently tracked the broader index.

Key changes for 2H25:

-

Yapı Kredi removed and replaced with Garanti Bank

-

Aselsan, which delivered 65% relative return since February, also removed

Current holdings include:

-

Turkish Airlines

-

Coca Cola İçecek

-

Ford Otosan

-

Mavi Giyim

-

Migros

-

Teknosa

-

TAV Airports

-

Turkcell

-

Tüpraş

The portfolio is equally weighted across all components.

IMPORTANT DISCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/