Turkey’s Treasury Faces Deepening Cash Deficit Despite $7 Billion in Foreign Borrowing

butce-acik

butce-acik

Summary: In June 2025, Turkey’s Treasury recorded a massive cash budget deficit of TRY 455 billion, widening the 12-month shortfall to TRY 2.38 trillion. Despite raising $7 billion from international markets during the month, Treasury cash reserves fell sharply, highlighting deep fiscal imbalances. July and August will bring record-high domestic and external debt repayments.

June Cash Budget Deficit Surges 116% Year-on-Year

According to data released by Turkey’s Ministry of Treasury and Finance:

-

The cash budget deficit in June 2025 rose to TRY 455 billion,

-

A 116% increase from the same month last year.

-

Over the last 12 months, the cumulative cash deficit has reached TRY 2.38 trillion,

-

Equivalent to 4.7% of GDP, compared to 5.2% at end-March.

Budget Performance at Risk of Overshooting 2025 Targets

While the government’s Medium-Term Program (OVP) projected a central government deficit of TRY 1.931 trillion for 2025:

-

More than half of that amount was already recorded in the first six months.

-

If the second-half performance deteriorates, the deficit-to-GDP ratio may exceed the 4.0% target.

-

Official forecasts expect the ratio to fall to 3.1% by end-2025.

Treasury Borrowing Rises, but Cash Reserves Shrink

Despite borrowing heavily in June, the Treasury’s cash reserves dropped sharply, due to large debt repayments:

-

The Treasury secured $7.0 billion from international markets,

-

Yet its total deposits with the Central Bank fell from TRY 1.2 trillion to TRY 817 billion.

Total net cash assets — including foreign currency and Turkish lira — declined to $7.6 billion, a level last seen during the peak of Turkey’s 2023 currency crisis.

Domestic and External Redemptions Surge in July–August

The upcoming months will test the Treasury’s resilience, with heavy debt repayments looming:

-

In July, the Treasury faces TRY 317 billion in domestic redemptions — well above the 12-month average.

-

In August, the figure rises to TRY 326 billion, nearly matching the peak levels projected for 2026.

-

On the external side, debt service totals $4.7 billion over July–August, including

-

$2.5 billion in principal and

-

$1.2 billion in interest payments.

-

Full-year 2025 external debt service is now estimated at $35.1 billion, approaching 2024’s record $35.4 billion.

Treasury Taps International Markets for $7 Billion in June

In June, the Treasury successfully raised:

-

$6.6 billion net via international bond issues.

-

Total foreign borrowing for 2025 now stands at $9.7 billion, out of a year-end target of $17.6 billion.

Revenues Rising, But Not Enough to Offset Spending Pressures

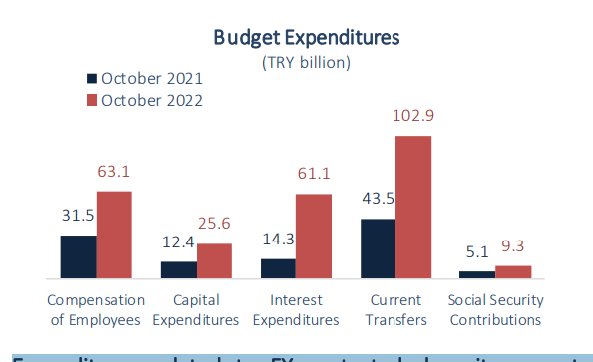

The Ministry’s June breakdown revealed:

-

Revenues rose 47%,

-

Expenditures increased 37%,

-

Non-interest spending rose 29%,

-

But interest payments doubled — up 100% year-on-year.

While tax revenues are improving, they remain insufficient to cover growing debt service costs and spending obligations. The result: continued reliance on borrowing and shrinking cash buffers.

IMPORTANT DISCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/