Türkiye’s Current Account Deficit Widens Sharply to $7.86B in April

Turkish Lira

Turkish Lira

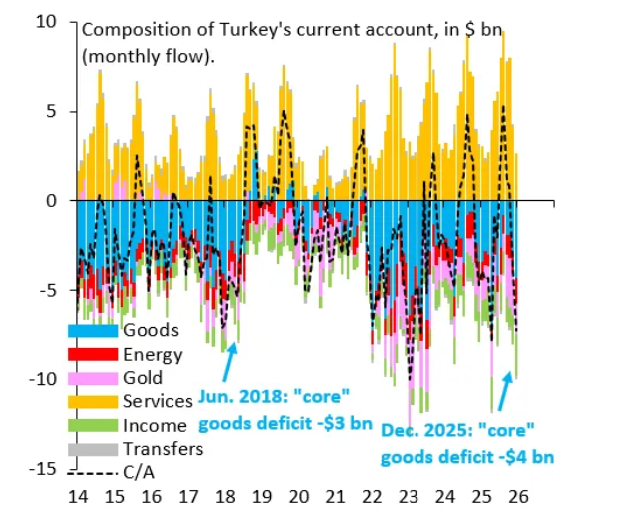

Türkiye’s current account deficit widened significantly in April 2025, reaching $7.864 billion, up from $4.087 billion in March, according to data released by the Central Bank of the Republic of Türkiye (CBRT).

Excluding gold and energy, the adjusted deficit stood at $1.938 billion, reflecting persistent structural pressures on the external balance.

Trade Deficit Surges Despite Tourism Revenues

The sharp rise in the deficit was primarily driven by a $9.891 billion foreign trade deficit, as per the balance of payments methodology. On a 12-month rolling basis, the current account shortfall reached $15.8 billion, while the trade deficit expanded to $60.4 billion.

However, service sector earnings continued to cushion the blow. Türkiye recorded a net inflow of $3.903 billion from services in April, with tourism revenues leading the way:

-

Travel income: $3.092 billion

-

Transport income: $1.6 billion

Massive Portfolio Investment Outflows Weaken Financial Position

On the financial account, Türkiye saw $10.877 billion in net outflows from portfolio investments.

Foreign investors:

-

Divested $6.4 billion from government debt securities

-

Pulled $147 million from the equities market

This marked one of the largest monthly exits in recent years.

Drop in Direct Investment and Real Estate Transactions

Net direct investment posted a $268 million outflow, with incoming investments totaling $408 million, while Turkish residents invested $676 million abroad.

Other highlights include:

-

Foreign purchases of Turkish real estate: $140 million

-

Turkish nationals’ real estate purchases abroad: $232 million

Central Bank Reserves Take a Hit

The CBRT also reported a $25 billion drop in official reserves, highlighting the growing pressure on external buffers amidst capital outflows and widening imbalances.

Conclusion

The surge in Türkiye’s April current account deficit, driven by external trade imbalance, capital flight, and declining foreign investment, underscores mounting vulnerabilities in the country’s external sector despite robust tourism revenues. The latest data signals a need for tighter fiscal discipline and renewed investor confidence to stabilize the balance of payments.