ANALYSIS: Turkey’s Current Account Deficit Remains Flat in March, Financing Fragility Persists

cari-acik

cari-acik

Turkey recorded a current account deficit of $4.1 billion in March, slightly above market expectations of $3.95 billion, and in line with analysts’ forecasts. The 12-month rolling deficit remained steady at $12.6 billion, reflecting a moderate performance in contrast to earlier projections. Despite the deficit, core indicators show promise, though the financing structure remains vulnerable.

Mixed Signals from Trade and Services

According to balance of payments data, March’s deficit was largely driven by a $5.04 billion trade gap, offset in part by $2.75 billion in services surplus. Over the past 12 months, the external trade deficit amounted to $58.1 billion, while services brought in $61.8 billion, suggesting services will continue to be a key stabilizer—especially from the second quarter onward.

Excluding gold and energy, the core current account showed a $1.47 billion surplus in March. While gold imports remain strong, downward pressure on energy prices is encouraging demand and improving the trade balance. The improvement in core indicators is expected to become more prominent in 2025, outpacing the headline figures.

Monetary Policy May Delay Projected Trends

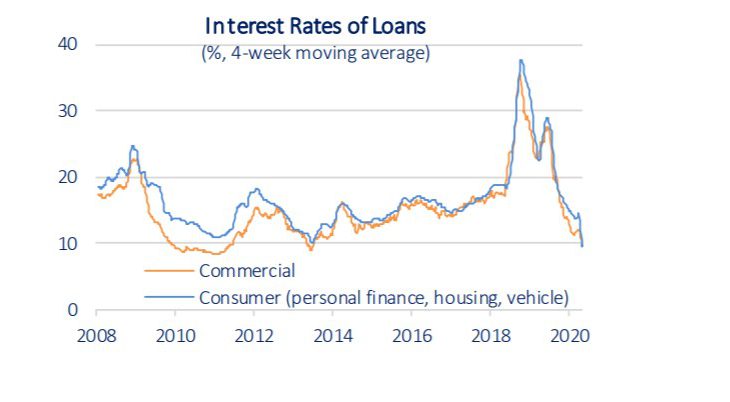

The Central Bank of Turkey (CBRT) has maintained a tight monetary policy stance, possibly delaying interest rate cuts initially projected for mid-year. However, if global disinflation continues and local inflation cools, sharper rate cuts may follow starting in June. May and June are seen as critical months for monetary policy direction and its impact on external balances.

Long-Term Financing Still Weak

Financing the current account deficit continues to be a key risk factor. In March, foreign direct investment brought in only $338 million, while portfolio investments recorded $3.55 billion in outflows. Foreign investors sold off $1.5 billion in government bonds and $0.4 billion in equities.

Banks and corporates turned to external borrowing, with banks securing $2.83 billion and corporates $581 million in new loans. However, these inflows were insufficient to counterbalance the overall deficit and capital outflows.

The CBRT’s official reserves fell sharply by $15.1 billion, largely due to capital outflows and statistical discrepancies. Over the past 12 months, hot money inflows—from portfolio investments and short-term borrowing—amounted to $31.5 billion, but long-term financing remains low at $5.5 billion.

Outlook: Deficit Likely to Widen

Forward-looking data signal further deterioration. Preliminary April figures from the Trade Ministry show a 22% year-over-year increase in the trade deficit, reaching $12 billion. Combined with slowing service revenues, the 12-month rolling current account deficit is expected to rise to $14.5–15 billion in April.

Analysts from multiple investment houses revised their year-end forecasts accordingly:

-

Garanti BBVA projects a 2025 current account deficit of $23 billion (1.5% of GDP), noting rising exports and tourism, but also higher net energy imports.

-

Gedik Investment highlights the sharp decline in reserves and the heavy reliance on bank external borrowing, which comprised $50 billion of the $59 billion in total capital inflows since August 2023.

Despite these risks, the decline in commodity prices—especially energy—and the potential pause in rate cuts could slow the pace of deficit growth. Gedik forecasts a year-end deficit of $22 billion, revising its earlier estimate of $25 billion.

Structural Risks and Policy Implications

While the current deficit-to-GDP ratio remains below 1%, significantly improved from the 5.5% peak in May 2023, structural fragilities persist. The core current account remains in surplus, but portfolio volatility, short-term inflows, and FX reserve depletion raise red flags.

A sustained tight monetary policy, supported by macroprudential regulations, is seen as critical in managing capital flow volatility. However, global uncertainties—such as US tariff policies and slowing global trade—could amplify external risks in the months ahead.

IMPORTANT DİSCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/